- Turk, James and John Rubino.

The Money Bubble.

Unknown: DollarCollapse Press, 2013.

ISBN 978-1-62217-034-0.

-

It is famously difficult to perceive when you're living

through a financial bubble. Whenever a bubble is expanding,

regardless of its nature, people with a short time horizon,

particularly those riding the bubble without experience of

previous boom/bust cycles, not only assume it will continue

to expand forever, they will find no shortage of

financial gurus to assure them that what, to an outsider

appears a completely unsustainable aberration is, in fact,

“the new normal”.

It used to be that bubbles would occur only around once in

a human generation. This meant that those caught up in them

would be experiencing one for the first time and

discount the warnings of geezers who were fleeced the

last time around. But in our happening world the pace of things

accelerates, and in the last 20 years we have seen three

successive bubbles, each segueing directly into the next:

- The Internet/NASDAQ bubble

- The real estate bubble

- The bond market bubble

The last bubble is still underway, although the first cracks

in its expansion have begun to appear at this writing.

The authors argue that these serial bubbles are the consequence

of a grand underlying bubble which has been underway for decades:

the money bubble—the creation out of thin air of currency

by central banks, causing more and more money to chase whatever

assets happen to be in fashion at the moment, thus resulting in

bubble after bubble until the money bubble finally pops.

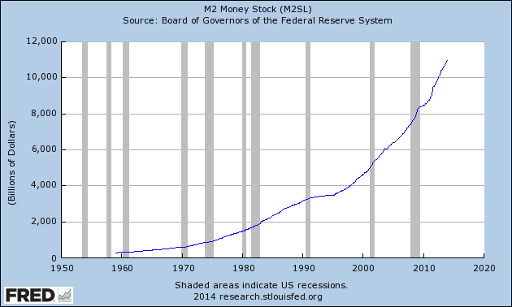

Although it can be psychologically difficult to diagnose a bubble

from the inside, if we step back to the abstract level of charts, it isn't

all that hard. Whenever you see an exponential curve climbing to

the sky, it's not only a safe bet but a sure thing that it won't

continue to do so forever. Now, it may go on much longer than you

might imagine: as

John Maynard Keynes

said, “Markets can

remain irrational a lot longer than you and I can remain

solvent”—but not forever. Let's look at a chart of

the M2 money stock (one of the measures of the supply of money

denominated in U.S. dollars) from 1959 through the end of 2013

(click the chart to see data updated through the present

date).

You will rarely see a more perfect exponential growth curve than this:

if you re-plot it on a semi-log axis, the fit to a straight line is

remarkable.

Ever since the creation of the Federal Reserve System in the United

States in 1913, and especially since the link between the U.S.

dollar and gold was severed in 1971, all of the world's principal

trading currencies have been

fiat money: paper

or book-entry money without any intrinsic value, created by a government

who enforces its use through

legal tender

laws. Since governments are the modern incarnation of the bands of

thieves and murderers who have afflicted humans ever since our

origin in Africa, it is to be expected that once such a band

obtains the power to create money which it can coerce its subjects

to use they will quickly abuse that power to loot their subjects

and enrich themselves, as least as long as they can keep the game

going. In the end, it is inevitable that people will wise up to the

scam, and that the paper money will be valuable only as scratchy

toilet paper. So it has been long before the advent of proper

toilet paper.

In this book the authors recount the sorry history of paper money

and debt-fuelled bubbles and examine possible scenarios as the

present unsustainable system inevitably comes to an end. It

is very difficult to forecast what will happen: we appear to be

heading for what

Ludwig von Mises

called a “crack-up boom”. This is where, as he wrote, “the

masses wake up”, and things go all nonlinear. The preconditions

for this are already in place, but there is no way to know when

it will dawn upon a substantial fraction of the population that

their savings have been looted, their retirement deferred until

death, their children indentured to a lifetime of debt, and their

nation destined to become a stratified society with a small fraction

of super-wealthy in their gated communities and a mass of impoverished

people, disarmed, dumbed down by design, and kept in line by

control of their means to communicate, travel, and organise. It is

difficult to make predictions beyond that point, as many disruptive things

can happen as a society approaches it. This is not an

environment in which one can make investment decisions as one

would have in the heady days of the 1950s.

And yet, one must—at least people who have managed to save for their

retirement and to provide their children a hand up in this

increasingly difficult world. The authors, drawing upon historical

parallels in previous money and debt bubbles, suggest what asset

classes to avoid, which are most likely to ride out the coming

turbulence and, for the adventure-seeking with some money left over

to take a flyer, a number of speculations which may perform well as

the money bubble pops. Remember that in a financial smash-up almost

everybody loses: it is difficult in a time of chaos, when assets

previously thought risk-free or safe are fluctuating wildly, just

to preserve your purchasing power. In such times those who

lose the least are the relative winners, and are in the

best position when emerging from the hard times to acquire assets

at bargain basement prices which will be the foundation of their

family fortune as the financial system is reconstituted upon a foundation

of sound money.

This book focusses on the history of money and debt bubbles, the

invariants from those experiences which can guide us as the

present madness ends, and provides guidelines for making the

most (or avoiding the worst) of what is to come. If you're looking

for “Untold Riches from the Coming Collapse”,

this isn't your book. These are very conservative recommendations

about what to do and what to avoid, and a few suggestions for

speculations, but the focus is on preservation of one's hard-earned

capital through what promises to be a very turbulent era.

In the Kindle edition the index cites page

numbers from the print edition which are useless since the Kindle

edition does not include page numbers.

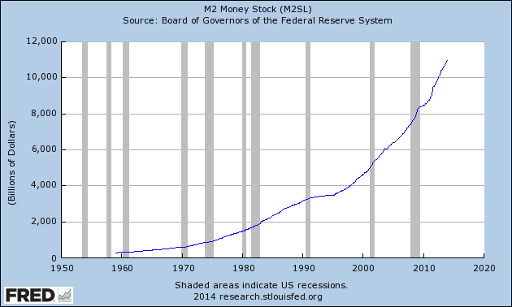

You will rarely see a more perfect exponential growth curve than this:

if you re-plot it on a semi-log axis, the fit to a straight line is

remarkable.

Ever since the creation of the Federal Reserve System in the United

States in 1913, and especially since the link between the U.S.

dollar and gold was severed in 1971, all of the world's principal

trading currencies have been

fiat money: paper

or book-entry money without any intrinsic value, created by a government

who enforces its use through

legal tender

laws. Since governments are the modern incarnation of the bands of

thieves and murderers who have afflicted humans ever since our

origin in Africa, it is to be expected that once such a band

obtains the power to create money which it can coerce its subjects

to use they will quickly abuse that power to loot their subjects

and enrich themselves, as least as long as they can keep the game

going. In the end, it is inevitable that people will wise up to the

scam, and that the paper money will be valuable only as scratchy

toilet paper. So it has been long before the advent of proper

toilet paper.

In this book the authors recount the sorry history of paper money

and debt-fuelled bubbles and examine possible scenarios as the

present unsustainable system inevitably comes to an end. It

is very difficult to forecast what will happen: we appear to be

heading for what

Ludwig von Mises

called a “crack-up boom”. This is where, as he wrote, “the

masses wake up”, and things go all nonlinear. The preconditions

for this are already in place, but there is no way to know when

it will dawn upon a substantial fraction of the population that

their savings have been looted, their retirement deferred until

death, their children indentured to a lifetime of debt, and their

nation destined to become a stratified society with a small fraction

of super-wealthy in their gated communities and a mass of impoverished

people, disarmed, dumbed down by design, and kept in line by

control of their means to communicate, travel, and organise. It is

difficult to make predictions beyond that point, as many disruptive things

can happen as a society approaches it. This is not an

environment in which one can make investment decisions as one

would have in the heady days of the 1950s.

And yet, one must—at least people who have managed to save for their

retirement and to provide their children a hand up in this

increasingly difficult world. The authors, drawing upon historical

parallels in previous money and debt bubbles, suggest what asset

classes to avoid, which are most likely to ride out the coming

turbulence and, for the adventure-seeking with some money left over

to take a flyer, a number of speculations which may perform well as

the money bubble pops. Remember that in a financial smash-up almost

everybody loses: it is difficult in a time of chaos, when assets

previously thought risk-free or safe are fluctuating wildly, just

to preserve your purchasing power. In such times those who

lose the least are the relative winners, and are in the

best position when emerging from the hard times to acquire assets

at bargain basement prices which will be the foundation of their

family fortune as the financial system is reconstituted upon a foundation

of sound money.

This book focusses on the history of money and debt bubbles, the

invariants from those experiences which can guide us as the

present madness ends, and provides guidelines for making the

most (or avoiding the worst) of what is to come. If you're looking

for “Untold Riches from the Coming Collapse”,

this isn't your book. These are very conservative recommendations

about what to do and what to avoid, and a few suggestions for

speculations, but the focus is on preservation of one's hard-earned

capital through what promises to be a very turbulent era.

In the Kindle edition the index cites page

numbers from the print edition which are useless since the Kindle

edition does not include page numbers.

January 2014