Books by Paul, Ron

- Paul, Ron.

End the Fed.

New York: Grand Central, 2000.

ISBN 978-0-446-54919-6.

-

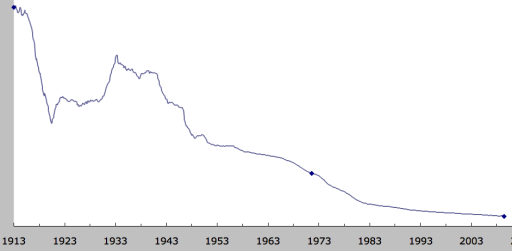

Imagine a company whose performance, measured over almost a century

by the primary metric given in its charter, looked

like this:

Now, would you be likely, were your own personal prosperity and that of all of

those around you on the line, to entrust your financial future to their

wisdom and demonstrated track record? Well, if you live in the United States, or

your finances are engaged in any way in that economy (whether as an investor,

creditor, or trade partner), you are, because this is the chart of

the purchasing power of the United States Dollar since it began to be managed

by the Federal Reserve System in 1913. Helluva record, don't you think?

Now, if you know anything about

basic economics

(which puts you several rungs up the ladder from most present-day

politicians and members of the chattering classes), you'll recall that

inflation is not defined as rising prices but rather an increase in the

supply of money. It's just as if you were at an auction and you gave all of

the bidders 10% more money: the selling price of the item would be 10%

greater, not because it had appreciated in value but simply because the

bidders had more to spend on acquiring it. And what is, fundamentally, the

function of the Federal Reserve System? Well, that would be to implement

an “elastic currency”, decoupled from real-world measures of

value, with the goal of smoothing out the business cycle. Looking at this

shorn of all the bafflegab, the mission statement is to create paper money

out of thin air in order to fund government programs which the legislature lacks

the spine to fund from taxation or debt, and to permit banks to profit by

extending credit well beyond the limits of prudence, knowing they're backed up

by the “lender of last resort” when things go South. The Federal

Reserve System is nothing other than an engine of inflation (money creation),

and it's hardly a surprise that the dollars it issues have lost more than 95%

of their value in the years since its foundation.

Acute observers of the economic scene have been warning about the

risks of such a system for decades—it came onto my personal

radar well before there was a human bootprint on the Moon. But somehow,

despite dollar crises, oil shocks, gold and silver bubble markets, saving and

loan collapse, dot.bomb, housing bubble, and all the rest, the wise money guys

somehow kept all of the balls in the air—until they didn't. We

are now in the early days of an extended period in which almost a century

of bogus prosperity founded on paper (not to mention, new and improved pure

zap electronic) money and debt which cannot ever be repaid will have to be

unwound. This will be painful in the extreme, and the profligate borrowers

who have been riding high whilst running up their credit cards will end up

marked down, not only in the economic realm but in geopolitical power.

Nobody imagines today that it would be possible, as Alan Greenspan envisioned

in the days he was a member of Ayn Rand's inner circle, to abolish the paper

money machine and return to honest money (or, even better, as Hayek recommended,

competing moneys, freely interchangeable in an open market). But then, nobody

imagines that the present system could collapse, which it is in the process of

doing. The US$ will continue its slide toward zero, perhaps with an inflection point

in the second derivative as the consequences of “bailouts” and

“stimuli” kick in. The Euro will first see

risk premiums

increase across sovereign debt issued by Eurozone nations, and then the

weaker members drop out to avoid the collapse of their own economies. No currency

union without political union has ever survived in the long term, and the Euro is

no exception.

Will we finally come to our senses and abandon this statist paper in favour of

the

mellow glow of gold?

This is devoutly to be wished, but I fear unlikely in my lifetime or even in

those of the koi in my pond. As long as politicians can fiddle with the money

in order to loot savers and investors to fund their patronage schemes and line

their own pockets they will: it's been going on since Babylon, and it will probably

go to the stars as we expand our dominion throughout the universe. One doesn't want

to hope for total economic and societal collapse, but that appears to be the best

bet for a return to honest and moral money. If that's your wish, I suppose you can

be heartened that the present administration in the United States appears bent upon

that outcome. Our other option is opting out with technology. We have the ability

today to electronically implement Hayek's multiple currency system online. This

has already been done by ventures such as e-gold, but The Man has, to date, effectively

stomped upon them. It will probably take a prickly sovereign state player to make

this work. Hello, Dubai!

Let me get back to this book. It is superb: read it and encourage all

of your similarly-inclined friends to do the same. If they're coming

in cold to these concepts, it may be a bit of a shock (“You

mean, the government doesn't create money?”), but

there's a bibliography at the end with three levels of reading lists

to bring people up to speed. Long-term supporters of hard money will

find this mostly a reinforcement of their views, but for those

experiencing for the first time the consequences of rapidly

depreciating dollars, this will be an eye-opening revelation of the

ultimate cause, and the malignant institution which must be abolished

to put an end to this most pernicious tax upon the most prudent of

citizens.

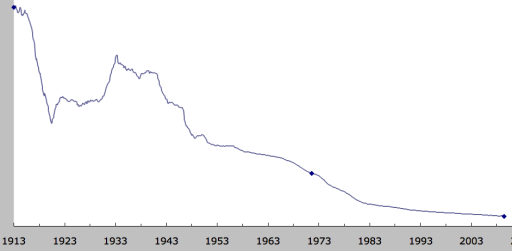

Now, would you be likely, were your own personal prosperity and that of all of

those around you on the line, to entrust your financial future to their

wisdom and demonstrated track record? Well, if you live in the United States, or

your finances are engaged in any way in that economy (whether as an investor,

creditor, or trade partner), you are, because this is the chart of

the purchasing power of the United States Dollar since it began to be managed

by the Federal Reserve System in 1913. Helluva record, don't you think?

Now, if you know anything about

basic economics

(which puts you several rungs up the ladder from most present-day

politicians and members of the chattering classes), you'll recall that

inflation is not defined as rising prices but rather an increase in the

supply of money. It's just as if you were at an auction and you gave all of

the bidders 10% more money: the selling price of the item would be 10%

greater, not because it had appreciated in value but simply because the

bidders had more to spend on acquiring it. And what is, fundamentally, the

function of the Federal Reserve System? Well, that would be to implement

an “elastic currency”, decoupled from real-world measures of

value, with the goal of smoothing out the business cycle. Looking at this

shorn of all the bafflegab, the mission statement is to create paper money

out of thin air in order to fund government programs which the legislature lacks

the spine to fund from taxation or debt, and to permit banks to profit by

extending credit well beyond the limits of prudence, knowing they're backed up

by the “lender of last resort” when things go South. The Federal

Reserve System is nothing other than an engine of inflation (money creation),

and it's hardly a surprise that the dollars it issues have lost more than 95%

of their value in the years since its foundation.

Acute observers of the economic scene have been warning about the

risks of such a system for decades—it came onto my personal

radar well before there was a human bootprint on the Moon. But somehow,

despite dollar crises, oil shocks, gold and silver bubble markets, saving and

loan collapse, dot.bomb, housing bubble, and all the rest, the wise money guys

somehow kept all of the balls in the air—until they didn't. We

are now in the early days of an extended period in which almost a century

of bogus prosperity founded on paper (not to mention, new and improved pure

zap electronic) money and debt which cannot ever be repaid will have to be

unwound. This will be painful in the extreme, and the profligate borrowers

who have been riding high whilst running up their credit cards will end up

marked down, not only in the economic realm but in geopolitical power.

Nobody imagines today that it would be possible, as Alan Greenspan envisioned

in the days he was a member of Ayn Rand's inner circle, to abolish the paper

money machine and return to honest money (or, even better, as Hayek recommended,

competing moneys, freely interchangeable in an open market). But then, nobody

imagines that the present system could collapse, which it is in the process of

doing. The US$ will continue its slide toward zero, perhaps with an inflection point

in the second derivative as the consequences of “bailouts” and

“stimuli” kick in. The Euro will first see

risk premiums

increase across sovereign debt issued by Eurozone nations, and then the

weaker members drop out to avoid the collapse of their own economies. No currency

union without political union has ever survived in the long term, and the Euro is

no exception.

Will we finally come to our senses and abandon this statist paper in favour of

the

mellow glow of gold?

This is devoutly to be wished, but I fear unlikely in my lifetime or even in

those of the koi in my pond. As long as politicians can fiddle with the money

in order to loot savers and investors to fund their patronage schemes and line

their own pockets they will: it's been going on since Babylon, and it will probably

go to the stars as we expand our dominion throughout the universe. One doesn't want

to hope for total economic and societal collapse, but that appears to be the best

bet for a return to honest and moral money. If that's your wish, I suppose you can

be heartened that the present administration in the United States appears bent upon

that outcome. Our other option is opting out with technology. We have the ability

today to electronically implement Hayek's multiple currency system online. This

has already been done by ventures such as e-gold, but The Man has, to date, effectively

stomped upon them. It will probably take a prickly sovereign state player to make

this work. Hello, Dubai!

Let me get back to this book. It is superb: read it and encourage all

of your similarly-inclined friends to do the same. If they're coming

in cold to these concepts, it may be a bit of a shock (“You

mean, the government doesn't create money?”), but

there's a bibliography at the end with three levels of reading lists

to bring people up to speed. Long-term supporters of hard money will

find this mostly a reinforcement of their views, but for those

experiencing for the first time the consequences of rapidly

depreciating dollars, this will be an eye-opening revelation of the

ultimate cause, and the malignant institution which must be abolished

to put an end to this most pernicious tax upon the most prudent of

citizens.

October 2009

- Paul, Ron.

The Revolution.

New York: Grand Central, 2008.

ISBN 978-0-446-53751-3.

-

Ron Paul's campaign for the 2008 Republican presidential

nomination has probably done more to expose voters in the

United States to the message of limited, constitutional

governance, individual liberty, non-interventionist

foreign policy, and sound money than any political

initiative in decades. Although largely ignored by the

collectivist legacy media, the stunning fund-raising success

of the campaign, even if not translated into corresponding

success at the polls, is evidence that this essentially

libertarian message (indeed, Dr. Paul ran for president in

1988 as the standard bearer of the Libertarian Party)

resonates with a substantial part of the American electorate,

even among the “millennial generation”,

which conventional wisdom believes thoroughly indoctrinated

with collectivist dogma and poised to vote away the last

vestiges of individual freedom in the United States. In

the concluding chapter, the candidate observes:

The fact is, liberty is not given a fair chance in

our society, neither in the media, nor in politics,

nor (especially) in education. I have spoken to many

young people during my career, some of whom had never

heard my ideas before. But as soon as I explained the

philosophy of liberty and told them a little American

history in light of that philosophy, their eyes lit

up. Here was something they'd never heard before, but

something that was compelling and moving, and which

appealed to their sense of idealism. Liberty had

simply never been presented to them as a choice.

(p. 158)

This slender (173 page) book presents that choice as

persuasively and elegantly as anything I have read.

Further, the case for liberty is anchored in the

tradition of American history and the classic

conservatism which characterised the Republican party

for the first half of the 20th century. The author

repeatedly demonstrates just how recent much of the

explosive growth in government has been, and observes

that people seemed to get along just fine, and the

economy prospered, without the crushing burden of

intrusive regulation and taxation. One of the most

striking examples is the discussion of abolishing the

personal income tax. “Impossible”, as

other politicians would immediately shout? Well,

the personal income tax accounts for about 40% of federal

revenue, so eliminating it would require reducing the

federal budget by the same 40%. How far back would you

have to go in history to discover an epoch where the

federal budget was 40% below that of 2007? Why, you'd

have to go all the way back to 1997! (p. 80)

The big government politicians who dominate both major

political parties in the United States dismiss the

common-sense policies advocated by Ron Paul in this book

by saying “you can't turn back the clock”. But

as Chesterton observed, why not? You can

turn back a clock, and you can replace disastrous policies

which are bankrupting a society and destroying personal liberty

with time-tested policies which have delivered prosperity

and freedom for centuries wherever adopted. Paul argues

that the debt-funded imperial nanny state is doomed in any case by

simple economic considerations. The only question is whether

it is deliberately and systematically dismantled by

the kinds of incremental steps he advocates here, or

eventually

collapses Soviet-style

due to bankruptcy and/or

hyperinflation. Should the U.S., as many expect, lurch

dramatically in the collectivist direction in the coming

years, it will only accelerate the inevitable debacle.

Anybody who wishes to discover alternatives

to the present course and that limited constitutional

government is not a relic of the past but the only

viable alternative for a free people to live in peace

and prosperity will find this book an excellent introduction

to the libertarian/constitutionalist perspective. A five

page reading list cites both classics of libertarian thought

and analyses of historical and contemporary events from a

libertarian viewpoint.

May 2008