« September 2008 | Main | November 2008 »

Thursday, October 30, 2008

Tough Customers

Wednesday, October 29, 2008

Reading List: The Death of the Grown-Up

- West, Diana. The Death of the Grown-Up. New York: St. Martin's Griffin, 2007. ISBN 978-0-312-34049-0.

- In The Case Against Adolescence (July 2007), Robert Epstein argued that the concept of adolescence as a distinct phase of life is a recently-invented social construct which replaced the traditional process of childhood passing into an apprenticeship to adulthood around the time of puberty. In this book, acid-penned author Diana West, while not discussing Epstein's contentions, suggests that the impact of adolescence upon the culture is even greater and more pernicious, and that starting with the Boomer generation, the very goal of maturing into an adult has been replaced by a “forever young” narcissism which elevates the behaviour of adolescence into the desideratum of people who previously would have been expected to put such childish things behind them and assume the responsibilities of adults. What do you get when you have a society full of superannuated adolescents? An adolescent culture, of course, addicted to instant gratification (see the debt crisis), lack of respect for traditional virtues and moderation, a preference for ignoring difficult problems in favour of trivial distractions, and for euphemisms instead of unpleasant reality. Such a society spends so much time looking inward that it forgets who it is or where it has come from, and becomes as easily manipulated as an adolescent at the hands of a quick-talking confidence man. And there are, as always, no shortage of such predators ready to exploit it. This situation, the author argues, crossing the line from cultural criticism into red meat territory, becomes an existential threat when faced with what she calls “The Real Culture War”: the challenge to the West from Islam (not “Islamists”, “Islamofascists”, “Islamic terrorists”, “militant fundamentalists” or the like, but Islam—the religion, in which she contends the institutions of violent jihad and dhimmitude for subjected populations which do not convert have been established from its early days). Islam, she says. is a culture which, whatever its shortcomings, does know what it is, exhorts its adherents to propagate it, and has no difficulty proclaiming its superiority over all others or working toward a goal of global domination. Now this isn't of course, the first time the West has faced such a threat: in just the last century the equally aggressive and murderous ideologies of fascism and communism were defeated, but they were defeated by an adult society, not a bunch of multicultural indoctrinated, reflexively cringing, ignorant or disdainful of their own culture, clueless about history, parents and grandparents whose own process of maturation stopped somewhere in their teens. This is a polemic, and sometimes reads like a newspaper op-ed piece which has to punch its message through in limited space as opposed to the more measured development of an argument appropriate to the long form. I also think the author really misses a crucial connection in not citing the work of Epstein and others on the damage wrought by the concept of adolescence itself—when you segregate young adults by age and cut them off from the contact with adults which traditionally taught them what adulthood meant and how and why they should aspire to it, is it any surprise that you end up with a culture filled with people who have never figured out how to behave as adults?

Monday, October 27, 2008

Nuclear Ninety North: Two Movies Added

I have added two streaming Flash videos to the Nuclear Ninety North travelogue: These movies run about 25 minutes each and require a broadband connection which can sustain a transfer rate of about 320 kilobits per second. The total download size for each of these movies is about 60 megabytes. I'm a rank amateur when it comes to videography; these movies are intended to give you a sense of being there, not for their aesthetic value. I learned a great deal about video prooduction on Linux in the process. The videos were produced with Kino, FFmpeg, and MEncoder.Saturday, October 25, 2008

Reading List: Empire of Lies

- Klavan, Andrew. Empire of Lies. New York: Harcourt, 2008. ISBN 978-0-15-101223-7.

- One perfect October Saturday afternoon, Jason Harrow, successful businessman, happily married father of three, committed Christian whose religion informs his moral sense, is sharing a lazy day with his family when the phone rings and sets into a motion an inexorable sequence of events which forces him to confront his dark past, when he was none of those things. Drawn from his prosperous life in the Midwest to the seamy world of Manhattan, he finds himself enmeshed in an almost hallucinatory web of evil and deceit which makes him doubt his own perception of reality, fearing that the dementia which consumed his mother is beginning to manifest itself in him, and that his moral sense is nothing but a veneer over the dark passions of his past. This is a thriller that thrills. Although the story is unusual for these days in having a Christian protagonist who is not a caricature, this is no Left Behind hymn-singing tract; in fact, the language and situations are quite rough and unsuitable for the less than mature. The author, two of whose earlier books have been adapted into the films True Crime and Don't Say a Word, has a great deal of fun at the expense of the legacy media, political correctness, and obese, dissipated, staccato-speaking actors who—once portrayed—dashing—spacefarers. If you fall into any of those categories, you may be intensely irritated by this book, but otherwise you'll probably, like me, devour it in a few sittings. I just finished it this perfect October Saturday afternoon, and it's one of the most satisfying thrillers I've read in years. A spoiler-free podcast interview with the author is available.

Wednesday, October 22, 2008

Gnome-o-gram: Tipping Point

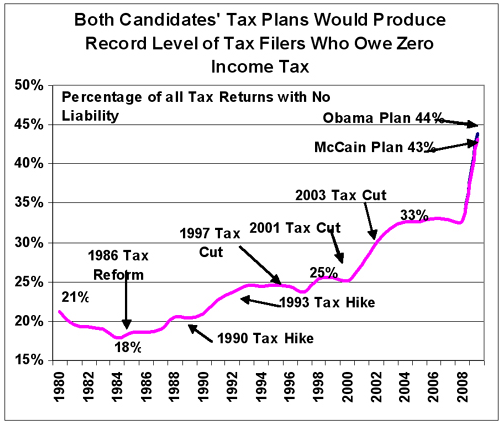

What is the tipping point at which the voters can be deemed to have made the disastrous discovery cited above, and a democratic polity begins its unrecoverable spiral into a state in which a dependent majority loots a shrinking productive minority, with the ultimately tragic consequences demonstrated with such dismaying frequency in history? Well, let's look at the following graph of the situation in the United States.A democracy cannot exist as a permanent form of government. It can only exist until the voters discover that they can vote themselves largesse from the public treasury.

— Source unknown, variously attributed

Graphic by the Tax Foundation

Monday, October 20, 2008

Reading List: De Havilland Comet

- Darling, Kev. De Havilland Comet. North Branch, MN: Specialty Press, 2001. ISBN 978-1-58007-036-2.

- If the Boeing 377 was the epitome and eventual sunset of the piston powered airliner, the De Havilland Comet was the dawn, or perhaps the false dawn, of the jet age. As World War II was winding down, the British Government convened a commission to explore how the advances in aviation during the war could be translated into commercial aircraft in the postwar era, and how the British aviation industry could transition from military production to a leadership position in postwar aviation. Among the projects proposed, the most daring was the “Type 4”, which eventually became the De Havilland Comet. Powered by British-invented turbojet engines, it would be a swept-wing, four engine aircraft with a cruising speed in excess of 500 miles per hour and a stage length of 1500 miles. Despite these daunting technological leaps, the British aviation industry rose to the challenge, and in July 1949, the prototype De Havilland Comet took to the air. After extensive testing, the Comet entered revenue service in May 1952, the first commercial jet-powered passenger service. Surely the jet age was dawning, and Britannia would rule it. And then disaster struck. First, three aircraft were lost due to the Comet's tetchy handling qualities and cockpit crews' unfamiliarity with the need to maintain speed in takeoff and landing with swept-wing aircraft. Another Comet was lost with all on board flying into a tropical storm in India. Analysis of the wreckage indicated that metal fatigue cracks at the corners of the square windows may have contributed to the structural failures, but this was not considered the definitive cause of the crash and Comets were permitted to continue to fly. Next, a Comet departed Rome and disintegrated in mid-air above the island of Elba, killing all on board. BOAC (the operator of the Comet in question) grounded their fleet voluntarily pending an investigation, but then reinstated flights 10 weeks later, as no probable cause had been determined for the earlier crashes. Just three days later, another BOAC aircraft, also departing Rome, disintegrated in the air near Naples, with no survivors. The British Civil Aviation Authority withdrew the Permit to Fly for the Comet, grounding all of the aircraft in operation. Assiduous investigation determined that the flaw in the Comet had nothing to do with its breakthrough jet propulsion, or the performance it permitted, but rather structural failure due to metal fatigue, which started at the aerial covers at the top of the fuselage, then disastrously propagated to cracks originating at the square corners of the windows in the passenger cabin. Reinforcement of the weak points of the fuselage and replacement of the square windows with oval ones completely solved this problem, but only after precious time had been lost and, with it, the Comet's chance to define the jet age. The subsequent Comets were a great success. The Comet 2 served with distinction with the Royal Air Force in a variety of capacities, and the Comet 4 became the flagship of numerous airlines around the globe. On October 4th, 1958, a Comet 4 inaugurated transatlantic jet passenger service, but just 22 days before the entry into service of the Boeing 707. The 707, with much greater passenger capacity (I remember the first time I saw one—I drew in my breath and said “It's so big”—the 747 actually had less impact on me than the 707 compared to earlier prop airliners) rapidly supplanted the Comet on high traffic city pairs. But the Comet lived on. In the aftermarket, it was the jet fleet leader of numerous airlines, and the flagship of British airtour operator Dan-Air. The Comet 4 was the basis for the Nimrod marine patrol aircraft, which has served with the Royal Air Force since 1971 and remains in service today. With lifetime extensions, it is entirely possible that Nimrod aircraft will remain on patrol a century after its progenitor, the Comet, first took to the air. This thorough, well-written, and lavishly illustrated (8 pages in colour) book provides comprehensive coverage of the Comet and Nimrod programmes, from concept through development, test, entry into service, tragedy, recovery, and eventual success (short-lived for the Comet 4, continuing for its Nimrod offspring).

Saturday, October 18, 2008

Computing: Filtering Forged Junk Mail Bounces with Procmail

Thanks to the multi-level defence in depth I've deployed against junk E-mail, described in earlier postings here and here, I have been receiving very little junk mail addressed directly to me—maybe one or two on a typical day (out of the five or ten thousand which are blocked at various steps in the mail processing pipeline). One problem remains: in addition to directly addressed mail, there are the bounces from junk mail forged as originating from my E-mail address. When you've had the same E-mail address for 14 years, this is an almost inevitable occurrence. Since the bounces originate from legitimate mail transfer agents, the connection-level filters and greylist which are so effective in deterring impatient non-standards-compliant robot mailers do not filter these messages, which must be caught by subsequent content filtering. Since most bounces quote the original message, content filtering has worked pretty well, but still I'd continue to get around ten of these bounces (out of several hundred which arrive) in my mailbox every day. Then last week things blew up. A new, massive, junk mail campaign has been launched, which sends forged messages which look something like the following:From: "Latisha Voss" <REDACTED@fourmilab.ch> X-Mailer: The Bat! (v2.00.2) Educational Reply-To: REDACTED@fourmilab.ch To: REDACTED@voliacable.com Subject: qcjpl http://REDACTED.com tjf b, d konu.I have redacted my E-mail address in the interest of privacy, and the name of the site to which the recipient is directed to avoid furthering the cause of the junk mailer. The target sites in these messages (they change once or twice a day to prevent filtering based on the URL) are all Flash pages which use the Flash redirect scam to send the user to a pill-pushing site. The forged name of the sender and the random text which follows the URL is different in every message. Messages like this slide right past most content filtering; there is nothing constant in the content which identifies them as junk, and the frequently-changing target URL makes it impractical to filter based upon it. The sheer volume of these messages since they exploded last week makes it imperative to do something—more than 500 per day were making it past all the filters and landing in my mailbox. Since I run Procmail as the penultimate line of defence (the last is the Bayesian filter in Mozilla Thunderbird), I decided to see if I could devise a rule which would catch these messages. After several experiments, I came up with the following, which I'll show here as for a user named “Chef Rodent” with an E-mail address of chef@ratburger.org:

:0 HB: * -1^0 * 1^0 ^From +.*MAILER\-DAEMON * 1^0 ^From:.*<chef@ratburger\.org> * -1^0 ^From:.*Chef +Rodent blowbackThis uses a Procmail weighted test in a very simple manner to identify messages with a “From” line including “MAILER-DAEMON”, a “From:” line with the user's E-mail address (which will appear in the body, showing the rejected message), but which do not include the user's correct name on the “From:” line. These characteristics are true of these forged messages, yet should be sufficiently rare as to generate few false positives. (And if there are a few, I don't care—it's just E-mail. Anybody who wants to be sure to contact me should use the feedback form or send a FAX.) This isn't perfect; nothing is in the world of junk mail filtering. Some bounces don't include “MAILER-DAEMON” in the “From” line, and others don't quote the bounced message. But, in my experience, this rule will catch about 99% of the bounced forged messages. You may want to mop up others with additional rules, but for the moment I'm happy with the results of this rule by itself. The rule files forgery bounces in a “blowback” folder; after I gain more confidence in it, I'll just send them directly to “/dev/null”. If you have a complicated .procmailrc file, this rule should probably be placed after any whitelist and blacklist rules and before content-based filters.

Friday, October 17, 2008

Reading List: Bad Money

- Phillips, Kevin. Bad Money. New York: Viking, 2008. ISBN 978-0-670-01907-6.

- I was less than impressed by the author's last book, American Theocracy (March 2007), so I was a little hesitant about picking up this volume—but I'm glad I did. This is, for its length, the best resource for understanding the present financial mess I've read. While it doesn't explain everything, and necessarily skips over much of the detail, it correctly focuses on the unprecedented explosion of debt in recent decades; the dominance of finance (making money by shuffling money around) over manufacturing (making stuff) in the United States; the emergence of a parallel, unregulated, fantasy-land banking system based on arcane financial derivatives; politicians bent on promoting home ownership whatever the risk to the financial system; and feckless regulators and central bankers who abdicated their responsibility and became “serial bubblers” instead. The interwoven fate of the dollar and petroleum prices, the near-term impact of a global peak in oil production and the need to rein in carbon emissions, and their potential consequences for an already deteriorating economic situation are discussed in detail. You will also learn why government economic statistics (inflation rate, money supply, etc.) should be treated with great scepticism. The thing about financial bubbles, and why such events are perennial in human societies, is that everybody wins—as long as the bubble continues to inflate and more suckers jump on board. Asset owners see their wealth soar, speculators make a fortune, those producing the assets enjoy ever-increasing demand, lenders earn more and more financing the purchase of appreciating assets, brokers earn greater and greater fees, and government tax revenues from everybody in the loop continue to rise—until the bubble pops. Then everybody loses, as reality reasserts itself. That's what we're beginning to see occur in today's financial markets: a grand-scale deleveraging of which events as of this writing (mid-October 2008) are just the opening act (or maybe the overture). The author sketches possible scenarios for how the future may play out. On the whole, he's a bit more optimistic than I (despite the last chapter's being titled “The Global Crisis of American Capitalism”), but then that isn't difficult. The speculations about the future seem plausible to me, but I can imagine things developing in far different ways than those envisioned here, many of which would seem far-fetched today. There are a few errors (for example, Vladimir Putin never “headed the KGB” [p. 192]: in fact he retired from the KGB in 1991 after returning from having served as an agent in Dresden), but none seriously affects the arguments presented. I continue to believe the author overstates the influence of the evangelical right in U.S. politics, and understates the culpability of politicians of both parties in creating the moral hazard which has now turned into the present peril. But these quibbles do not detract from this excellent primer on how the present crisis came to be, and what the future may hold.

Thursday, October 16, 2008

The “You know” Report: Third U.S. Presidential Debate

The third and thankfully final debate between U.S. presidential candidates John McCain and Barack Obama took place last night at Hofstra University, and as ever, Fourmilog has scrutinised the CNN transcript for the inarticulate, time buying, phrases interjected by the candidates. The results, compared to those of last time are nothing less than stunning—you'd think the debate coaches had been reading these “you know” reports!| McCain | Obama | |

|---|---|---|

| “You know”s | 4 | 6 |

| “My friends”s | 2 | 0 |

| “Look”s | 5 | 7 |

Reading List: Apollo

- Bean, Alan and Andrew Chaikin. Apollo. Shelton, CT: The Greenwich Workshop, 1998. ISBN 978-0-86713-050-8.

- On November 19th, 1969, Alan Bean became the fourth man to walk on the Moon, joining Apollo 12 commander Pete Conrad on the surface of Oceanus Procellarum. He was the first person to land on the Moon on his very first space flight. He later commanded the Skylab 3 mission in 1973, spending more than 59 days in orbit. Astronauts have had a wide variety of second careers after retiring from NASA: executives, professors, politicians, and many others. Among the Apollo astronauts, only Alan Bean set out, after leaving NASA in 1981, to become a professional artist, an endeavour at which he has succeeded, both artistically and commercially. This large format coffee table book collects many of his paintings completed before its publication in 1998, with descriptions by the artist of the subject material of each and, in many cases, what he was trying to achieve artistically. The companion text by space writer Andrew Chaikin (A Man on the Moon) provides an overview of Bean's career and the Apollo program. Bean's art combines scrupulous attention to technical detail (for example, the precise appearance of items reflected in the curved visor of spacesuit helmets) with impressionistic brushwork and use of colour, intended to convey how the lunar scenes felt, as opposed to the drab, near monochrome appearance of the actual surface. This works for some people, while others find it grating—I like it very much. Visit the Alan Bean Gallery and make up your own mind. This book is out of print, but used copies are available. (While mint editions can be pricey, non-collector copies for readers just interested in the content are generally available at modest cost).

Monday, October 13, 2008

Reading List: The Obama Nation

- Corsi, Jerome L. The Obama Nation. New York: Threshold Editions, 2008. ISBN 978-1-4165-9806-0.

- The author of this book was co-author, with John O'Neill, of the 2004 book about John Kerry, Unfit for Command (October 2004), which resulted in the introduction of the verb “to swiftboat” into the English language. In this outing, the topic is Barack Obama, whose enigmatic origin, slim paper trail, and dubious associates are explored here. Unlike the earlier book, where his co-author had first-hand experience with John Kerry, this book is based almost entirely on secondary sources, well documented in end notes, with many from legacy media outlets, in particular investigative reporting by the Chicago Sun-Times and Chicago Tribune. The author concludes that behind Obama's centrist and post-partisan presentation is a thoroughly radical agenda, with long-term associations with figures on the extreme left-wing fringe of American society. He paints an Obama administration, especially if empowered by a filibuster-proof majority in the Senate and a House majority, as likely to steer American society toward a European-like social democratic agenda in the greatest veer to the left since the New Deal. Is this, in fact, likely? Well, there are many worrisome, well-sourced, items here, but then one wonders about the attention to detail of an author who believes that Germany is a permanent member of the United Nations Security Council (p. 262). Lapses like this and a strong partisan tone undermine the persuasiveness of the case made here. I hear that David Freddoso's The Case Against Barack Obama is a better put argument, grounded in Obama's roots in Chicago machine politics rather than ideology, but I haven't read that book and I probably won't as the election will surely have gone down before I'd get to it. If you have no idea where Obama came from or what he believes, there are interesting items here to follow up, but I wouldn't take the picture presented here as valid without independently verifying the source citations and making my own judgement as to their veracity.

Sunday, October 12, 2008

Computing: Isbniser Check Digit Fix

Isbniser is a little Perl program I wrote to interconvert book numbers in the ISBN-10 and ISBN-13 systems. You enter a book number in either format, with or without delimiters, and obtain its designation in both forms, with and without delimiters. (Non-978 “Bookland” ISBN-13 codes cannot, of course, be expressed in ISBN-10.) For example:$ isbniser 0-9340-3563-6 ISBN-10: 0-9340-3563-6 0934035636 ISBN-13: 9780934035637 978-0-9340-3563-7As it happens, there was a flaw in the original version of this program which resulted in the computation of an incorrect check digit for ISBN-13 codes whose correct ISBN-10 check digit was 0. This has been fixed, and the updated version is ready to download from the accustomed place.

Saturday, October 11, 2008

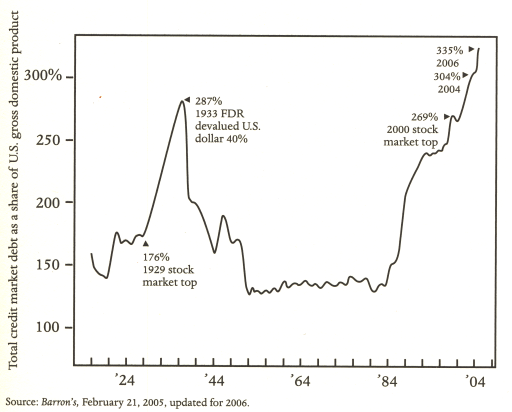

Gnome-o-gram: Deleveraging—It's All About the Debt

You could read almost all of the voluminous coverage of the present crisis in the financial markets in the legacy media without ever encountering the essential term which describes what's going on at the “big picture” level, understanding the underlying cause for the events in the news, or comprehending the magnitude of the problem and how protracted may be its consequences. The following chart, from p. 7 of Kevin Phillips's Bad Money, encapsulates everything you need to know about the present situation. This is not a “mortgage crisis”, “derivatives crisis”, “credit crisis”, or any of the other terms bandied about describing aspects of the larger situation—it is a debt crisis and it always has been. The United States have experienced a multi-decade bubble market, rolling over from equities and real estate in the 1980s, to technology stocks in the 1990s, and back to residential real estate in the aughties, all driven by an unprecedented explosion of debt, as illustrated below.

Friday, October 10, 2008

Radio at All Times—at All Places

Millennials, grasp the concept—your great-grandparents had access to “Real Entertainment—Anywhere—Anytime”, sent wirelessly to their personal mobile receivers, offering free selection among a multitude (well, actually several) broadcast programmes, all pretty much the same. How things have changed! Now your iPhone can stream Web video and audio from around the world, wherever you happen to be, but what about your physical well being? I'm talking about muscle tone. That trendy appliance may plug you in to the global feed, but what's it doing for your cardiovascular health? You want red blooded mobile connectivity? Check out the Knight Portable Radio from 1930! Six tubes—single dial tuning—all batteries included (let's not get into how long they last), with a ready-to-take-into-the-sticks weight of just 26.5 pounds (12 kg). This and many other wonders will be posted as our four-page-per-week serialisation of the 1930 Allied Radio Catalogue continues at Fourmilab.Wednesday, October 8, 2008

The “You know” Report: Second U.S. Presidential Debate

You know, my friends, it's a tedious job, but somebody has to do it. Last night John McCain and Barack Obama met in Nashville, Tennessee for their second “debate”, this time in “town hall” format. (Funny, I don't recall town hall meetings having a superstar news reader as “moderator”.) Anyway, as usual, Fourmilab was on the beat, ready to scan the CNN transcript of the debate for the verbal crutch of our era, “you know”. This time, because of the Republican candidate's fondness for “my friends”, I've added that phrase to the tally.| McCain | Obama | |

|---|---|---|

| “You know”s | 22 | 15 |

| “My friends”s | 22 | 0 |