« March 2018 | Main | May 2018 »

Tuesday, April 17, 2018

Earth and Moon Viewer: Solar System Explorer

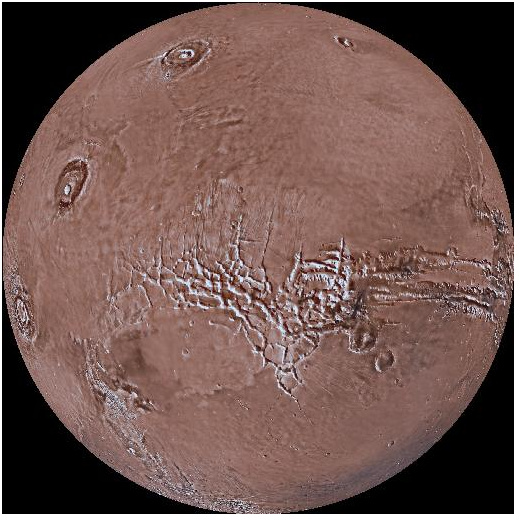

With the release of version 3.0, now in production, Earth and Moon Viewer, originally launched on the Web in 1994 as Earth Viewer, now becomes “Earth and Moon Viewer and Solar System Explorer”. In addition to viewing the Earth and its Moon using a variety of image databases, you can now also explore high-resolution imagery of Mercury, Venus, Mars and its moons Phobos and Deimos, the asteroids Ceres and Vesta, and Pluto and its moon Charon. For some bodies multiple image databases are available including spacecraft imagery and topography based upon elevation measurements. You can choose any of the available worlds and image databases from the custom request form. All of the viewing options available for the Earth and Moon can be used when viewing the other bodies with the exception of viewing from an Earth satellite. Imagery is based upon the latest spacecraft data published by the United States Geological Survey Astrogeology Science Center. For example, here is an image of the west part of Valles Marineris with Noctis Labyrinthus at the centre of the image and the three Tharsis volcanoes toward the left. The image is rendered from an altitude of 1000 km using the Viking orbiter global mosaic with 232 metres per pixel resolution.

Thursday, April 12, 2018

Reading List: Antifragile

- Taleb, Nassim Nicholas. Antifragile. New York: Random House, 2012. ISBN 978-0-8129-7968-8.

-

This book is volume three in the author's

Incerto series, following

Fooled by Randomness (February 2011) and

The Black Swan (January 2009).

It continues to explore the themes of randomness, risk,

and the design of systems: physical, economic, financial,

and social, which perform well in the face of uncertainty

and infrequent events with large consequences. He begins by

posing the deceptively simple question, “What is the

antonym of ‘fragile’?”

After thinking for a few moments, most people will answer

with “robust” or one of its synonyms such as

“sturdy”, “tough”, or

“rugged”. But think about it a bit more: does

a robust object or system actually behave in the opposite

way to a fragile one? Consider a teacup made of fine china. It

is fragile—if subjected to more than a very limited amount

of force or acceleration, it will smash into bits. It is

fragile because application of such an external stimulus, for

example by dropping it on the floor, will dramatically degrade

its value for the purposes for which it was created (you can't

drink tea from a handful of sherds, and they don't look good

sitting on the shelf). Now consider a teacup made of stainless

steel. It is far more robust: you can drop it from ten

kilometres onto a concrete slab and, while it may be slightly

dented, it will still work fine and look OK, maybe even acquiring

a little character from the adventure. But is this really the

opposite of fragility? The china teacup was degraded by the

impact, while the stainless steel one was not. But are there

objects and systems which improve as a result of random

events: uncertainty, risk, stressors, volatility, adventure,

and the slings and arrows of existence in the real world? Such

a system would not be robust, but would be genuinely

“anti-fragile” (which I will subsequently write

without the hyphen, as does the author): it welcomes these

perturbations, and may even require them in order to function

well or at all.

Antifragility seems an odd concept at first. Our experience is

that unexpected events usually make things worse, and that

the inexorable increase in entropy causes things to degrade

with time: plants and animals age and eventually die; machines

wear out and break; cultures and societies become decadent, corrupt,

and eventually collapse. And yet if you look at nature,

antifragility is everywhere—it is the mechanism which

drives biological evolution, technological progress, the

unreasonable effectiveness of free market systems in efficiently meeting

the needs of their participants, and just about

everything else that changes over time, from trends in art,

literature, and music, to political systems, and human

cultures. In fact, antifragility is a property of most

natural, organic systems, while fragility (or at best, some

degree of robustness) tends to characterise those which

were designed from the top down by humans. And one of the

paradoxical characteristics of antifragile systems is that

they tend to be made up of fragile components.

How does this work? We'll get to physical systems and finance

in a while, but let's start out with restaurants. Any

reasonably large city in the developed world will have a

wide variety of restaurants serving food from numerous

cultures, at different price points, and with ambience

catering to the preferences of their individual clientèles. The

restaurant business is notoriously fragile: the culinary

preferences of people are fickle and unpredictable, and

restaurants who are behind the times frequently go under.

And yet, among the population of restaurants in a given

area at a given time, customers can usually find what

they're looking for. The restaurant population

or industry is antifragile, even though it is

composed of fragile individual restaurants which come

and go with the whims of diners, which will be catered

to by one or more among the current, but ever-changing

population of restaurants.

Now, suppose instead that some Food Commissar in the

All-Union Ministry of Nutrition carefully studied the

preferences of people and established a highly-optimised

and uniform menu for the monopoly State Feeding Centres, then

set up a central purchasing, processing, and distribution

infrastructure to optimise the efficient delivery of these

items to patrons. This system would be highly fragile, since

while it would deliver food, there would no feedback

based upon customer preferences, and no competition to

respond to shifts in taste. The result would be a mediocre

product which, over time, was less and less aligned with

what people wanted, and hence would have a declining

number of customers. The messy and chaotic market of

independent restaurants, constantly popping into existence

and disappearing like virtual particles, exploring the culinary

state space almost at random, does, at any given moment,

satisfy the needs of its customers, and it responds to

unexpected changes by adapting to them: it is antifragile.

Now let's consider an example from metallurgy. If you

pour molten metal from a furnace into a cold mould, its

molecules, which were originally jostling around

at random at the high temperature of the liquid metal,

will rapidly freeze into a structure with small crystals

randomly oriented. The solidified metal will contain

dislocations wherever two crystals meet, with each

forming a weak spot where the metal can potentially

fracture under stress. The metal is hard, but brittle:

if you try to bend it, it's likely to snap. It is

fragile.

To render it more flexible, it can be subjected to the

process of

annealing,

where it is heated to a high temperature (but below melting),

which allows the molecules to migrate within the bulk of the

material. Existing grains will tend to grow, align, and merge,

resulting in a ductile, workable metal. But critically, once

heated, the metal must be cooled on a schedule which provides

sufficient randomness (molecular motion from heat) to allow the process

of alignment to continue, but not to disrupt already-aligned

crystals. Here is a video from

Cellular Automata Laboratory

which demonstrates annealing. Note how sustained randomness

is necessary to keep the process from quickly “freezing up”

into a disordered state.

Tuesday, April 3, 2018

Earth and Moon Viewer: New Topographic Maps

Since 1996, Earth and Moon Viewer has offered a topographic map of the Earth as one of the image databases which may be displayed. This map was derived from the NOAA/NCEI ETOPO2 topography database. Although the original data set contained samples with a spatial resolution of two arc seconds (two nautical miles per pixel, or a total image size of 10800×5400 pixels), main memory and disc size constraints of the era required reducing the resolution of the image within Earth and Moon Viewer to 1440×720 pixels. This was sufficient for renderings at the hemisphere or continental scale, but if you zoomed in closer, the results were disappointing. For example, here is a view of Spain, Portugal, France, and North Africa viewed from 207 kilometres above the centre of the Iberian peninsula. More than twenty years later, in the age of “extravagant computing”, and on the threshold of the Roaring Twenties, we can do much better than this. I have re-processed the raw ETOPO2 data set to preserve its full resolution, and with pixels which can represent 65,536 unique colours instead of the 256 used before. Here is the same image rendered from the new ETOPO2 data.

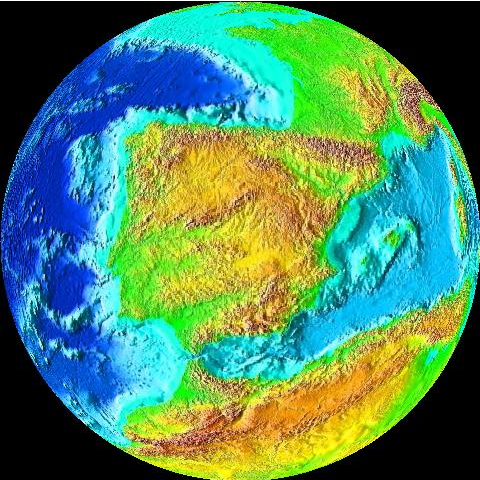

More than twenty years later, in the age of “extravagant computing”, and on the threshold of the Roaring Twenties, we can do much better than this. I have re-processed the raw ETOPO2 data set to preserve its full resolution, and with pixels which can represent 65,536 unique colours instead of the 256 used before. Here is the same image rendered from the new ETOPO2 data.

The colours in this rendering are somewhat garish and nonetheless do not necessarily show fine detail well. Images with this database tend to look their best at either very large scale or zoomed in to near the resolution limits of the database.

In 2009, the ETOPO1 data set was released, replacing ETOPO2 for most applications. The data have twice the spatial resolution: 1 arc minute, corresponding to one nautical mile per pixel or a total image size of 21600×10800 pixels. The permanent ice sheets of Antarctica, Greenland, and some Arctic islands are included in the elevation data. Earth and Moon Viewer now provides access to a rendering of this data set, which may be selected as “NOAA/NCEI ETOPO1 Global Relief” on any page which allows choosing an Earth imagery source. The full resolution of the database is available for close-ups. Here is the same view as that above rendered with the ETOPO1 data set.

The colours in this rendering are somewhat garish and nonetheless do not necessarily show fine detail well. Images with this database tend to look their best at either very large scale or zoomed in to near the resolution limits of the database.

In 2009, the ETOPO1 data set was released, replacing ETOPO2 for most applications. The data have twice the spatial resolution: 1 arc minute, corresponding to one nautical mile per pixel or a total image size of 21600×10800 pixels. The permanent ice sheets of Antarctica, Greenland, and some Arctic islands are included in the elevation data. Earth and Moon Viewer now provides access to a rendering of this data set, which may be selected as “NOAA/NCEI ETOPO1 Global Relief” on any page which allows choosing an Earth imagery source. The full resolution of the database is available for close-ups. Here is the same view as that above rendered with the ETOPO1 data set.

The original low-resolution ETOPO2 data set remains available for compatibility with saved URLs which reference it, but is not directly requested by Earth and Moon Viewer's query pages.

The original low-resolution ETOPO2 data set remains available for compatibility with saved URLs which reference it, but is not directly requested by Earth and Moon Viewer's query pages.