« July 2011 | Main | September 2011 »

Saturday, August 27, 2011

Reading List: Lords of Finance

- Ahamed, Liaquat. Lords of Finance. New York: Penguin Press, 2009. ISBN 978-0-14-311680-6.

- I have become increasingly persuaded that World War I was the singular event of the twentieth century in that it was not only an unprecedented human tragedy in its own right (and utterly unnecessary), it set in motion the forces which would bring about the calamities which would dominate the balance of the century and which still cast dark shadows on our world as it approaches one century after that fateful August. When the time comes to write the epitaph of the entire project of the Enlightenment (assuming its successor culture permits it to even be remembered, which is not the way to bet), I believe World War I will be seen as the moment when it all began to go wrong. This is my own view, not the author's thesis in this book, but it is a conclusion I believe is strongly reinforced by the events chronicled here. The present volume is a history of central banking in Europe and the U.S. from the years prior to World War I through the institution of the Bretton Woods system of fixed exchange rates based on U.S. dollar reserves backed by gold. The story is told through the careers of the four central bankers who dominated the era: Montagu Norman of the Bank of England, Émile Moreau of la Banque de France, Hjalmar Schact of the German Reichsbank, and Benjamin Strong of the U.S. Federal Reserve Bank of New York. Prior to World War I, central banking, to the extent it existed at all in anything like the modern sense, was a relatively dull field of endeavour performed by correspondingly dull people, most aristocrats or scions of wealthy families who lacked the entrepreneurial bent to try things more risky and interesting. Apart from keeping the system from seizing up in the occasional financial panic (which was done pretty much according to the playbook prescribed in Walter Bagehot's Lombard Street, published in 1873), there really wasn't a lot to do. All of the major trading nations were on a hard gold standard, where their paper currency was exchangeable on demand for gold coin or bullion at a fixed rate. This imposed rigid discipline upon national governments and their treasuries, since any attempt to inflate the money supply ran the risk of inciting a run on their gold reserves. Trade imbalances would cause a transfer of gold which would force partners to adjust their interest rates, automatically cooling off overheated economies and boosting those suffering slowdowns. World War I changed everything. After the guns fell silent and the exhausted nations on both sides signed the peace treaties, the financial landscape of the world was altered beyond recognition. Germany was obliged to pay reparations amounting to a substantial fraction of its GDP for generations into the future, while both Britain and France had run up debts with the United States which essentially cleaned out their treasuries. The U.S. had amassed a hoard of most of the gold in the world, and was the only country still fully on the gold standard. As a result of the contortions done by all combatants to fund their war efforts, central banks, which had been more or less independent before the war, became increasingly politicised and the instruments of government policy. The people running these institutions, however, were the same as before: essentially amateurs without any theoretical foundation for the policies this unprecedented situation forced them to formulate. Germany veered off into hyperinflation, Britain rejoined the gold standard at the prewar peg of the pound, resulting in disastrous deflation and unemployment, while France revalued the franc against gold at a rate which caused the French economy to boom and gold to start flowing into its coffers. Predictably, this led to crisis after crisis in the 1920s, to which the central bankers tried to respond with Band-Aid after Band-Aid without any attempt to fix the structural problems in the system they had cobbled together. As just one example, an elaborate scheme was crafted where the U.S. would loan money to Germany which was used to make reparation payments to Britain and France, who then used the proceeds to repay their war debts to the U.S. Got it? (It was much like the “petrodollar recycling” of the 1970s where the West went into debt to purchase oil from OPEC producers, who would invest the money back in the banks and treasury securities of the consumer countries.) Of course, the problem with such schemes is there's always that mountain of debt piling up somewhere, in this case in Germany, which can't be repaid unless the economy that's straining under it remains prosperous. But until the day arrives when the credit card is maxed out and the bill comes due, things are glorious. After that, not so much—not just bad, but Hitler bad. This is a fascinating exploration of a little-known epoch in monetary history, and will give you a different view of the causes of the U.S. stock market bubble of the 1920s, the crash of 1929, and the onset of the First Great Depression. I found the coverage of the period a bit uneven: the author skips over much of the financial machinations of World War I and almost all of World War II, concentrating on events of the 1920s which are now all but forgotten (not that there isn't a great deal we can learn from them). The author writes from a completely conventional wisdom Keynesian perspective—indeed Keynes is a hero of the story, offstage for most of it, arguing that flawed monetary policy was setting the stage for disaster. The cause of the monetary disruptions in the 1920s and the Depression is attributed to the gold standard, and yet even the most cursory examination of the facts, as documented in the book itself, gives lie to this. After World War I, there was a gold standard in name only, as currencies were manipulated at the behest of politicians for their own ends without the discipline of the prewar gold standard. Further, if the gold standard caused the Depression, why didn't the Depression end when all of the major economies were forced off the gold standard by 1933? With these caveats, there is a great deal to be learned from this recounting of the era of the first modern experiment in political control of money. We are still enduring its consequences. One fears the “maestros” trying to sort out the current mess have no more clue what they're doing than the protagonists in this account. In the Kindle edition the table of contents and end notes are properly linked to the text, but source citations, which are by page number in the print edition, are not linked. However, locations in the book are given both by print page number and Kindle “location”, so you can follow them, albeit a bit tediously, if you wish to. The index is just a list of terms without links to their appearances in the text.

Sunday, August 21, 2011

Reading List: After America

- Steyn, Mark. After America. Washington: Regnery Publishing, 2011. ISBN 978-1-59698-100-3.

- If John Derbyshire's We Are Doomed (October 2009) wasn't gloomy enough for you, this book will have you laughing all way from the event horizon to the central singularity toward which what remains of Western civilisation is free falling. In the author's view, the West now faces a perfect storm of demographic collapse (discussed in detail in his earlier America Alone [November 2006]); financial cataclysm due to unsustainable debt and “entitlement” commitments made by the welfare state; a culture crash after two generations have been indoctrinated in dependency, multiculturalism, and not just ignorance but a counterfactual fantasy view of history; and a political and cultural élite which has become so distinct and disconnected from the shrinking productive classes it almost seems to be evolving into a separate species. Steyn uses H. G. Wells's The Time Machine as his guide to the future, arguing that Wells got the details right but that bifurcation of mankind into the effete Eloi and the productive but menacing Morlocks is not in the remote future, but has already happened in Western society in every sense but the biological, and even that is effectively the case as the two castes increasingly rarely come into contact with one another, no less interbreed. The Eloi, what Angelo Codevilla called The Ruling Class (October 2010), are the product of top-ranked universities and law schools and dominate government, academia, and the media. Many of them have been supported by taxpayers their entire lives and have never actually done anything productive in their careers. The Obama administration, which is almost devoid of individuals with any private sector experience at the cabinet level, might be deemed the first all-Eloi government in the U.S. As Wells's Time Traveller discovered, the whole Eloi/Morlock thing ended badly, and that's what Steyn envisions happening in the West, not in the distant future or even by mid-century, but within this decade, absent radical and painful course changes which are difficult to imagine being implemented by the feckless political classes of Europe, the U.S., and Japan. In a chilling chapter, Steyn invokes the time machine once again to deliver a letter from the middle of our century to a reader in the America of 1950. In a way the world he describes would be as alien to its Truman administration reader as any dystopian vision of Wells, Orwell, or Huxley, and it is particularly disturbing to note that most of the changes he forecasts have already taken place or their precipitating events already underway in trends which are either impossible or extremely difficult to reverse. A final chapter, which I'll bet was added at the insistence of the publisher, provides a list of things which might be done to rescue the West from its imminent demise. They all make perfect sense, are easily understood, and would doubtless improve the situation even if inadequate to entirely avoid the coming calamity. And there is precisely zero chance of any of them being implemented in a country where 52.9% of the population voted for Barack Obama in 2008, at the tipping point where a majority dependent on the state and state employees who tend to them outvote a minority of productive taxpayers. Regular readers of Steyn's columns will find much of this material familiar—I suspect there was more than a little cut and paste in assembling this manuscript. The tone of the argument is more the full-tilt irony, mockery, and word play one expects in a column than the more laid back voice customary in a book. You might want to read a chapter every few days rather than ploughing right through to the end to avoid getting numbed. But then the writing is so good it's difficult to put down. In the Kindle edition, end notes are properly linked to the text and in notes which cite a document on the Web, the URL is linked to the on-line document. The index, however, is simply a useless list of terms without links to references in the text.

Thursday, August 18, 2011

Gnome-o-gram: Parkinson's Law and the U.S. Public Debt

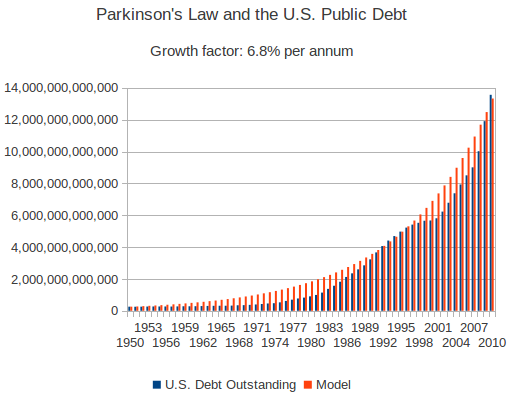

I've long been interested in long-term exponential growth curves, and when I happened across a chart of the U.S. statutory debt limit (which was much in the news recently, due to the stand-off over the most recent increase), I couldn't help noticing just how exponential it looked. So, I decided to see how well the actual U.S. public debt (the actual debt, not the limit) fit a model of exponential growth and, if so, what the compounded rate of growth was. Bottom line: it's pretty much exponential, with a growth rate from 1950 through 2010 of around 6.8% per annum. Here's a chart of my hand-fit to the data series: I made this fit simply by adjusting the exponent until the growth from 1950 approximated the figure for 2010, and was amazed how close the fit was. I didn't do any fancy least squares regression—if you'd like to fiddle with the data yourself, you're welcome to download the LibreOffice spreadsheet I used to prepare this chart. The data are from the U.S. Treasury Bureau of the Public Debt.

What is fascinating about this is that Parkinson's Law, albeit having been variously formulated since its first statement in 1955, predicts that the staff within a bureaucracy will expand at a rate between 5 and 7 percent per year, “irrespective of any variation in the amount of work (if any) to be done.” Isn't it interesting that government debt falls precisely within this range? Now, aggregate public debt in depreciating nominal dollars is a very different kind of statistic than an easily-quantified metric like headcount, but reality has a way of going all Pareto on you, and I wouldn't be startled in the least to discover a similar exponential growth fit with a comparable exponent to many other socio-economic time series. You may find a better exponential fit to the debt if you start with 1971, when Nixon closed the gold window.

Gentlemen (and ladies), start your (analytical) engines!

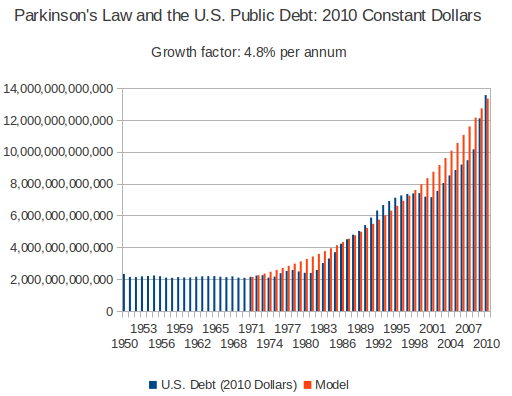

Update: On further reflection, I wondered what this chart might look like if I displayed the debt in inflation-adjusted constant dollars instead of depreciating nominal dollars. In the chart below, the blue debt bars have been adjusted to 2010 dollars according to the average Consumer Price Index (CPI) for each year. (Yes, I am fully aware that the CPI is increasingly bogus, but you have to use something, and this is a statistic which is widely used and well understood.)

I made this fit simply by adjusting the exponent until the growth from 1950 approximated the figure for 2010, and was amazed how close the fit was. I didn't do any fancy least squares regression—if you'd like to fiddle with the data yourself, you're welcome to download the LibreOffice spreadsheet I used to prepare this chart. The data are from the U.S. Treasury Bureau of the Public Debt.

What is fascinating about this is that Parkinson's Law, albeit having been variously formulated since its first statement in 1955, predicts that the staff within a bureaucracy will expand at a rate between 5 and 7 percent per year, “irrespective of any variation in the amount of work (if any) to be done.” Isn't it interesting that government debt falls precisely within this range? Now, aggregate public debt in depreciating nominal dollars is a very different kind of statistic than an easily-quantified metric like headcount, but reality has a way of going all Pareto on you, and I wouldn't be startled in the least to discover a similar exponential growth fit with a comparable exponent to many other socio-economic time series. You may find a better exponential fit to the debt if you start with 1971, when Nixon closed the gold window.

Gentlemen (and ladies), start your (analytical) engines!

Update: On further reflection, I wondered what this chart might look like if I displayed the debt in inflation-adjusted constant dollars instead of depreciating nominal dollars. In the chart below, the blue debt bars have been adjusted to 2010 dollars according to the average Consumer Price Index (CPI) for each year. (Yes, I am fully aware that the CPI is increasingly bogus, but you have to use something, and this is a statistic which is widely used and well understood.)

From this perspective, things look quite different: the public debt in 2010 constant dollars barely budged from 1950 until 1971, when Nixon closed the gold window and decoupled the dollar from gold. Without the discipline of gold (before, if the U.S. ran up large deficits and printed money to cover them, foreign central banks could exchange the excess dollars for gold, emptying out the treasury's vault), there was no constraint on the issuance of debt and the creation of dollars and the curve began to climb to the sky, slowly at first and then at an accelerating pace. Here I've fit an exponential to the period from 1971 through 2010, and once again it fits pretty well, with a growth factor of 4.8% per year, just a tad below Parkinson's range of five to seven percent.

If you'd like to explore this further, you can download the spreadsheet from which this chart was produced as well as a spreadsheet of the CPI from 1913 through 2010. (2011-08-19 17:48 UTC)

From this perspective, things look quite different: the public debt in 2010 constant dollars barely budged from 1950 until 1971, when Nixon closed the gold window and decoupled the dollar from gold. Without the discipline of gold (before, if the U.S. ran up large deficits and printed money to cover them, foreign central banks could exchange the excess dollars for gold, emptying out the treasury's vault), there was no constraint on the issuance of debt and the creation of dollars and the curve began to climb to the sky, slowly at first and then at an accelerating pace. Here I've fit an exponential to the period from 1971 through 2010, and once again it fits pretty well, with a growth factor of 4.8% per year, just a tad below Parkinson's range of five to seven percent.

If you'd like to explore this further, you can download the spreadsheet from which this chart was produced as well as a spreadsheet of the CPI from 1913 through 2010. (2011-08-19 17:48 UTC)

Wednesday, August 10, 2011

Reading List: The Day the Dollar Died

- Galt, John [pseud.]. The Day the Dollar Died. Florida: Self-published, 2011.

- I have often remarked in this venue how fragile the infrastructure of the developed world is, and how what might seem to be a small disruption could cascade into a black swan event which could potentially result in the end of the world as we know it. It is not only physical events such as EMP attacks, cyber attacks on critical infrastructure, or natural disasters such as hurricanes and earthquakes which can set off the downspiral, but also loss of confidence in the financial system in which all of the myriad transactions which make up the global division of labour on which our contemporary society depends. In a fiat money system, where currency has no intrinsic value and is accepted only on the confidence that it will be subsequently redeemable for other goods without massive depreciation, loss of that confidence can bring the system down almost overnight, and this has happened again and again in the sorry millennia-long history of paper money. As economist Herbert Stein observed, “If something cannot go on forever, it will stop”. But, when pondering the many “unsustainable” trends we see all around us today, it's important to bear in mind that they can often go on for much longer, diverging more into the world of weird than you ever imagined before stopping, and that when they finally do stop the débâcle can be more sudden and breathtaking in its consequences than even excitable forecasters conceived. In this gripping thriller, the author envisions the sudden loss in confidence of the purchasing power of the U.S. dollar and the ability of the U.S. government to make good on its obligations catalysing a meltdown of the international financial system and triggering dire consequences within the United States as an administration which believes “you never want a serious crisis to go to waste” exploits the calamity to begin “fundamentally transforming the United States of America”. The story is told in a curious way: by one first-person narrator and from the viewpoint of other people around the country recounted in third-person omniscient style. This is unusual, but I didn't find it jarring, and the story works. The recounting of the aftermath of sudden economic collapse is compelling, and will probably make you rethink your own preparations for such a dire (yet, I believe, increasingly probable) event. The whole post-collapse scenario is a little too black helicopter for my taste: we're asked to simultaneously believe that a government which has bungled its way into an apocalyptic collapse of the international economic system (entirely plausible in my view) will be ruthlessly efficient in imposing its new order (nonsense—it will be as mindlessly incompetent as in everything else it attempts). But the picture painted of how citizens can be intimidated or co-opted into becoming collaborators rings true, and will give you pause as you think about your friends and neighbours as potential snitches working for the Man. I found it particularly delightful that the author envisions a concept similar to my 1994 dystopian piece, Unicard, as playing a part in the story. At present, this book is available only in PDF format. I read it with Stanza on my iPad, which provides a reading experience equivalent to the Kindle and iBooks applications. The author says other electronic editions of this book will be forthcoming in the near future; when they're released they should be linked to the page cited above. The PDF edition is perfectly readable, however, so if this book interests you, there's no reason to wait. And, hey, it's free! As a self-published work, it's not surprising there are a number of typographical errors, although very few factual errors I noticed. That said, I've read novels published by major houses with substantially more copy editing goofs, and the errors here never confuse the reader nor get in the way of the narrative. For the author's other writings and audio podcasts, visit his Web site.