|

|

Autodesk, Inc. was officially incorporated in California on April 26, 1982. I wrote this information letter just after finishing all of the paperwork associated with the incorporation, including mailing stock certificates, options, and warrants to all of the founders.

This letter is to bring you up to date on the progress since the last letter, pass on some additional information about products with suggestions of who does what and some random company and product notes. If you have not already received one or been sent a copy, this letter will be accompanied with a copy of the “Autodesk Design Guide”, the working paper for the final version of the Autodesk database system. Comments and suggestions regarding all of the enclosed are solicited.

Since every other name for which there was a general consensus of acceptability was unacceptable to California as a corporation name (due to being too close to somebody else's), the company ended up being called “Autodesk, Inc.” (AI). If we think of the perfect name, we can always change it. In the meanwhile, I'll use “AI” when referring to the company and “Autodesk” when referring to the product with the same name.

The corporation was created by filing the Articles of Incorporation with the Secretary of State on April 9, 1982. The officers and board of directors were elected on April 16, 1982. The first phase of organisation of the company was completed on April 26, 1982, when the stock was sold to the founders (all California residents, as described in “Information Letter #4”), and the notes for stock purchased by loan were signed. The money from the stock sale was then deposited in a new account for AI opened at First Interstate Bank. Thus, the company is now officially formed and operating. Officers of the company were chosen as follows:

President: John Walker

Vice President and Secretary: Dan Drake

Treasurer (CFO) and Assistant Secretary: Keith Marcelius

Assistant Secretary: Bob Tufts

The doubling up of offices permits critical documents which require signature by “(President or Vice President) and (Secretary or Assistant Secretary)” to be filed when one of the officers is unavailable. Designating our attorney, Bob Tufts, as Assistant Secretary allows routine matters which require signature by a Secretary to be handled without getting all the officers together. This form of organisation is typical of companies of our type.

The Board of Directors is as follows:

Dan Drake

Keith Marcelius

Jack Stuppin

John Walker

As mentioned in Information Letter #4, the board consists of those who are willing to get together and deal with the matters the board is required to deal with. There were no other volunteers, so the board is as suggested in that letter.

Neither the slate of officers nor the board membership is cast in concrete, of course.

Legal requirements forced several changes in the original Organisation Plan (OP) of March 2, 1982, which was sent with Information Letter #3. As far as I know, the following list of changes is all-inclusive. None of these changes significantly affects the status of any participant in the company, and none has any adverse affect we've been able to think of.

In the OP the warrants were stated to expire in 18 months. This has been changed to 4 years to give the recipients of the warrants more flexibility in deciding when to convert them into shares. The stock options issued to the out of state people will have the same term.

In the OP, the specifics of the stock option issuance were spelled out in an agreement in principle. The stock option plan finally adopted will be as stated in the OP. At this point, we have in effect a “legal boilerplate” option plan which allows the flexibility needed to accommodate the plan described in the OP, plus the ability to bring in the out of state people via options as described in IL #4.

Jack Stuppin is an employee of a member firm of the New York Stock Exchange, and is hence prohibited from being an employee of any other company. As a result, he cannot be an employee of AI, but he can be a director. He can still work for the company in the capacity of director. Since he's not an employee, we can't grant him stock options like the other employees, so we issued him warrants as a director.

The only other change from Information Letter #4 is that Marinchip Systems Ltd. was issued warrants for the stock it is to purchase over the next year. In IL #4, MSL was listed as purchasing stock for a note. Since only employees can purchase stock for a note, and a corporation can't be an employee, we accomplished the same effect by issuing warrants. (Actually this way is slightly better: this way, MSL does not gain a vote in the operation of the company until it comes up with the money. Had we issued it stock for a note, it would gain the votes immediately.)

In terms of organising the company, the next step is to hire the out-of-state participants and grant them the stock options which they will use to effect their purchases of stock. Two options will be granted to all out-of-state participants: a 60 day option for initial purchase of stock, and a 4 year option equivalent to the 4 year warrant sold to California residents. Out-of-state participants will be given a note to sign to exercise the 60 day option identical to that signed by the California people. The 60 days in the option are simply to give people time to get the money in our hands, as this can take a while for international transfers.

Once the 60 day options have been exercised, everybody (California and out-of-state) will be on an equal basis, the company will be running, and then we'll hopefully be able to stop worrying about the form and get to work on the substance—developing products and selling them.

Included with this mailing is a W-4 form for tax withholding which, even though we are paying salaries at the staggering rate of $1/year, we must have from all employees. We don't yet know how this works for overseas people, so if you're one of them just keep the form for the moment until we find out from the U.S. tax people. U.S. people, please fill out the form and return it to us in the enclosed SASE.

If you are a non-California resident, you will also find enclosed an employee agreement. This agreement has already been executed by all the California people. We must have this agreement as evidence of employment before we can issue the employee stock option that you will use to acquire your original share in the company. A duplicate agreement is enclosed for your records.

Bob Tufts has asked us to inform all participants that if they feel that their interests are being violated by the corporation, they are urged to contact their own legal counsel. This information was passed on to all people in the initial offering, and I am repeating it here for completeness.

To avoid the last-minute panic meetings which have characterised our operation through the organisation period, we've set up regular monthly meetings on the first weekend of every month, with the first meeting in June 1982. On even numbered months, the meeting will be on Sunday, on odd numbered months, Saturday (since neither day was preferable to everybody). Hence, the next meeting is Sunday, June 6, 1982. The location of each meeting will be set at the preceding meeting, and will be at various places to share the travel burden among the participants. The next meeting will be at Jack Stuppin's house in San Francisco (directions are in Information Letter #3).

The agenda of these meetings will be a review of company progress, product status, and other matters as described in the original Working Paper. We'll try to work the meetings so that technical sessions about specific products can be worked in at the end to aid people who are collaborating on products in getting together.

In the process of evaluating products and getting the work done, participants will need to buy manuals for various products, supplies for machines provided by AI, etc. Our intent is that manuals you need to evaluate products, etc., can be handled by a petty cash mechanism—you buy it and send the receipt to AI, which will refund the money to you. If in doubt, call and ask. (In some cases, we know places to get things cheaper than the local computer store or direct from the manufacturer. Also, somebody else might have one you can borrow.) To avoid disputes, it's wise to clear everything first, but something like a $35 manual for a package competitive with one we're developing will naturally be O.K.

By combining AI's orders with MSL's ongoing business, we can get floppy discs and other computer supplies at very low prices. We will centrally purchase these items and ship them out to people as requested. We'll try to keep reasonable quantities of all the normal supplies in stock here, so Bay Area people can get what they need next day by UPS. Shipping costs make this crazy for overseas people, so we will reimburse them for supplies expenses from receipts they submit.

We now have a formal agreement with Mike Riddle for transfer of MicroCAD to the company in return for royalties to Mike to compensate him for his personal development of the package. Thus, we're now on the way with one of our major products. Mike has been working with a CP/M 86 system he owns (on a Godbout 8085/8088 board) and has been using an IBM Personal Computer at the local Computerland store on off-hours. He has acquired the Microsoft Macro Assembler and tested it, and has determined how to interconvert programs between PCDOS/MSDOS and CP/M 86. This means we can develop on one and sell on both.

Current thinking is that our best path to getting MicroCAD running

on the 8086/8088 is to port SPL and recompile with it. Now that

we have an assembler, we have all the key tools in hand to move

the META and SPL complex. Although we will have to do a

substantial amount of 8086 assembly code to move the package, when

we're done we'll control the compiler, and that allows us to take

advantage of floating point chip options, extended memory beyond

what IBM's operating system supports (which you can buy off the

shelf today), and other such selling points much faster than if we

had to wait for our language vendor to get around to supporting

them. One of the major hassles in using the 8086 is the memory

segmentation architecture to address large memory

spaces.![]() Controlling the compiler allows us to be sure we won't be limited

by the language to less memory than the machine allows.

Controlling the compiler allows us to be sure we won't be limited

by the language to less memory than the machine allows.

To this end, Mike is plugging away on the SPL port. Once we get our IBM machine, we'll be able to increase the pace of this effort.

At the moment, the Autodesk package is being designed by Kern Sibbald, Keith Marcelius, and John Walker. The attached copy of the design guide, which is the starting point for this design, is for your review. Please forward any comments and suggestions to one of the people mentioned above. If you want to get involved in the product design, you're welcome to. There's plenty left to do.

We're planning to implement Autodesk in CB80 for CP/M. We've worked enough with CB80 so far to trust it to hold up for a project of Autodesk's size. Also, since the prototype system developed for the Computer Faire was written in QBASIC, some parts, such as the large screen editor module, can be lifted and used essentially as-is.

The status of all of the other products is as listed in the enclosed products note. I think it's making more and more sense to look at QBASIC as a product because of the expected long delay before Microsoft delivers their true compiler for the IBM PC, the expectation that CB86 (whenever it is ready) will run only under CP/M 86, not PCDOS, and for our own use in porting our CBASIC products to the PC and other 8086/8088 systems. Also, as noted in the products bulletin, if we port SPL, we'll have done a lot of the work needed to port QBASIC already. We'd also be in an excellent position to move it to the 68000 and ace Digital Research out of the CBASIC market.

In the mass market, the initial impression made by the packaging of the product (including the format and quality of its documentation), user aids, and dealer training tools. As you look at other products, try to keep these things in mind and note any good ideas you see or hear about from others. Products like Autodesk and MicroCAD need to look as professional as their operation is, and we need to think about what we should be doing in that way as we develop the products for initial marketing.

Digital Research can get away with crummy manuals because everybody knows them and respects their products. We can't because nobody will have heard of us, and if our manuals and packaging look amateurish then potential customers will assume our products are as well.

Two questions I'd like to ask everybody are:

“What is the best software manual you've ever used?”

“What made it so good and so useful?”

I'm sure we can produce manuals as good as any in the industry. But first we need to decide what we want to make. Let me know your thoughts.

We have been assuming since IL #2 that we lacked the option to organise the company as a Subchapter S corporation because any corporation with nonresident alien (i.e. overseas) stockholders is ineligible for Subchapter S. It turns out that because of the way we're bringing in the non-California people, there is a reasonably attractive alternative we should consider (I will studiously avoid using the word “option” here except when I mean “qualified employee stock option”—hence all the “alternatives” herein).

First of all, what is a Subchapter S corporation? A normal corporation has assets and liabilities just like an individual. When the corporation makes money, the only way it can get it out to the owners is by paying dividends, which are taxed twice, or by paying salaries. More important in the case of start-up companies, if the corporation loses money, the losses simply reduce the net worth of the corporation; they cannot be used to reduce the stockholders' tax liability (but they can be carried forward and used to offset the corporation's future profits). (However, if the corporation goes totally belly-up, the stockholders can deduct the loss on the then-worthless stock.)

A Subchapter S corporation works very much like a partnership for tax purposes while retaining the limited liability and flexibility of a corporation. The net profit or loss from the corporation is simply divided among the shareholders based on percent ownership and declared on their tax returns on Schedule E as regular income. Since most corporations lose money in the start-up period (while you're doing the development, writing off the equipment you bought, and doing initial advertising), a Subchapter S corporation can pass these losses directly out to the people who, after all, put up the money that's being lost, so they can reduce their income taxes. If the company loses, say, $20000 in the first year and you own 5%, that means you can deduct $1000 from your income. If you're in the 35% marginal tax bracket, that means you keep about $350 rather than giving it to Uncle Sam. Good pay for filling out a form.

If the company starts to make money and you decide you don't want to be Subchapter S any more, you can change to a regular corporation. Once you've done that, you can't change back to Subchapter S for 5 years.

One catch in Subchapter S is that California law doesn't recognise it. That means that earnings are double taxed in California. But remember that the California top tax bracket is only (did I say only?) 11%, and besides it's better to save Federal taxes anyway, even if you don't save on California.

O.K., now that we all understand what Subchapter S is, how can we go with it even though we have overseas participants? The thing that makes it possible is that the overseas people are acquiring their stock through employee stock options, not through direct purchases. The law says that if you have a foreign stockholder, you're ineligible for Subchapter S, but there's nothing wrong with granting an option to somebody, as long as it isn't exercised. As soon the holder of that option sends his money and says, “Send me the stock”, you're immediately bounced out of Subchapter S, but up to that time it's fine.

Now the plan so far has been that the non-California people would get 60 day options, which they would immediately exercise for their initial stock purchase. The alternative is to make the initial options for, say, 2 years, not exercisable until either 1 year has passed or the company has dropped Subchapter S. Mike Riddle, who's out of state but not overseas could still receive a 60 day option and exercise it immediately—his case is irrelevant to this discussion because it's only overseas shareholders which cause the Subchapter S problem.

Now what would this mean for the domestic shareholders and the overseas people? The domestic shareholders would be able to deduct the initial losses by the company from their taxes. As most of the participants have other jobs and are in reasonably high tax brackets, this would result in substantial reductions in their tax bills. The overseas participants would be able to defer their initial stock purchase in the company, keeping their money until the option exercise time began. This would mean that they would not have to come up with the money right away, and if the company collapsed, would not be out the amount of the initial stock purchase, as they could let the option expire unexercised. If the company becomes successful, the option guarantees them their share at the initial offering price, so they can buy in on the same basis as the domestic people.

Let's look at the disadvantages. The domestic shareholders would be the only people putting up money immediately, so the company would not have access to the working capital generated by sales of shares to overseas people. The overseas people, once they exercised their options, would not have the prior losses of the company to reduce the corporate taxes paid on the (we hope) current profits of the company.

I think that in terms of financial benefits and disadvantages that this alternative is reasonable. The domestic people get to take advantage of tax benefits which wouldn't otherwise be available. The foreign people lose some benefits, but are compensated by having a year's use of their money before having to make the initial stock purchase, plus eventually owning a piece of a company whose initial capitalisation was done by the domestic people.

On the other hand, I think that this may simply be so confusing and hard to analyse that maybe we'd just be better off paying the money to the feds and getting to work writing software rather than further complicating the structure of the company. I personally feel very ambivalent about this matter. I certainly don't want to do anything which would make either the domestic or the foreign people feel like either was taking advantage of the other, so if anybody at all is concerned about it from that aspect, I think we should just forget it.

If we want to do it, here are the basic constraints: we have 75 days from April 9 to elect Subchapter S, and to do so we have to file a form with signatures of all stockholders and their spouses. Maybe we should start circulating the form just in case, so we have it if we decide to go ahead. Next, we need to get letters from all the overseas people giving their assurance that they understand the arrangement and that they approve it. This is required because they are foregoing the loss carry forward which reduces their eventual payouts on the stock (even though they are presumably compensated by not having to put up the money right away).

It seems to me that this is something that requires absolutely unanimous consent by everybody involved, so if you don't like it, let me know (and why). If you don't understand it, I'd be glad to “clarify” it at greater length (although at the present rate, I don't know how many pages that might take).

This note describes planned and potential products of Autodesk. The products are listed here in no particular order.

The product is a computer-aided design and drafting system. This product currently exists on the Marinchip 9900 computer in SPL. Our plan is to convert it to the IBM Personal Computer either by translating it to C or Digital Research PL/1, or by porting SPL to the 8086. We would also be able to offer a very high performance system using the Godbout 10 Mhz 8086/8087 S-100 system.

Installed on a desktop computer configuration in the $10K to $15K range, it is competitive in performance and features to Computervision CAD systems in the $70K range. There are no known competitive products on microcomputers today (although there are some very simpleminded screen drawing programs for the Apple, and we must be careful to explain how we differ).

We can probably obtain substantial free publicity by issuing press releases and writing articles stressing the tie-in with computer aided design and the IBM robot controlled by the IBM personal computer. We can also aim our ads to sell the product as a “word processor for drawings”. Potential customers are anybody who currently produces drawings. Small architectural offices are ideal prospects.

We can make add-ons to the package to make it an engineering workstation. It could be used to enter, edit, and view structural engineering information, for example, or to interactively view and edit plots made on mainframe computers and transmitted downline.

The package has been sold as a software package on the M9900 at $1000. There are about 20 installations at present, no substantial promotion has been done.

Autodesk is an office automation system for small computers. It embodies a computer model of an office environment. It provides file cards, file boxes, a calendar, etc. This is connected to a very simple database and query system. The entire system is intended to be extremely user-friendly and straightforward, We want a computer store salesman to be able to get an off-the-street prospect who's never seen a computer before to be using the package in 5 minutes or less. That will help him sell hardware, and he'll sell our software with it.

This package has an almost unlimited potential for add-on products for installed customers. Electronic mail, fancier filing, report writer modules, data entry systems, etc., can all be sold as add-ons to the basic system.

A prototype of the package written on QBASIC on the M9900 exists. Some of the largest sections of this can be used as part of the final product if CB80 is used on CP/M.

Based on the pricing of “card file” systems with much less capability, I would assume the system would sell for from $250 to $450 retail. This is a product which would probably sell very well on the Apple, if we could get it running on one.

This is a screen editor written in QBASIC currently running on the M9900. About 100 to 200 are installed currently. A version converted to CB80 exists on CP/M, which needs only a line database module to be converted to be complete.

This product can be sold on CP/M as a competitor to VEDIT, probably the dominant product of its type. I think we'd have to bring it out for, say $99 to establish it. We want to price it in the “impulse purchase” range by the standards of computer stores. I don't think any substantial development work or extensions are in order here. This is a quickie product to get some money coming in.

This is a file compare program written in QBASIC. With about 3 days work it can be cleaned up and converted to CP/M. This is a very useful software tool not generally available on CP/M systems. I think we can sell it for about $50, probably directly. Its value is getting some publicity and generating some fast revenue. It could be expanded into something like the Unix source code control system if it surprises us and becomes a best-seller.

We can also offer a version that knows how to compare WordStar files. It could insert commands for change bars, and provide this very handy feature to WordStar users.

This product combines one of the most useful management and planning tools, linear programming, with the most popular user interface for planning, Visi-Calc. Visi-Calc allows you to specify dependencies of items and ask “what if”. Opti-Calc lets you point at numbers and say to hold them constant, point at other numbers and say to maximise or minimise them, then it will set up the LP problem, solve it, and display the numbers changed as a result of the optimisation. This would make our product stand head and shoulders above all the competition, and properly handled should sell as fast as we can make them.

Other than the concept above, no work has been done on this product. Somebody who knows LP needs to design this thing after first gaining an in-depth understanding of Visi-Calc.

One of the best selling utilities today is telecommunication software. Kern Sibbald has rewritten our TS utility from the 9900 in QBASIC, so we can convert it to CB80 for CP/M. To make it in the CP/M world we need to add lots of silly little features such as being able to do a directory within the program, etc. We'll also need to make it store a database of people, auto-dial by name, etc. My idea for how to distinguish it is to make it programmable in a simple language so you can preprogram dialogues for access to remote systems. That way you could code up a query access dialogue like the Apple Dow Jones program for any system and easily change it when the system changed. We would of course include preprogrammed dialogues for the most popular database services. The dialogue setup should be very simple—possibly something like PILOT might work—it's essential that an end user can develop dialogue scripts without calling us.

JPLDIS is a public domain information management system written in

Fortran by JPL. A re-implementation of it in assembly language

called DBASE II![]() is selling

like hotcakes at $800 a pop. We can get the Fortran source from

COSMIC, convert it to something, and have a product. Somebody needs to

get the sucker and see what we're in for here. It's a lot of FORTRAN,

but if it will compile right through Microsoft FORTRAN, we may have a

fast product.

is selling

like hotcakes at $800 a pop. We can get the Fortran source from

COSMIC, convert it to something, and have a product. Somebody needs to

get the sucker and see what we're in for here. It's a lot of FORTRAN,

but if it will compile right through Microsoft FORTRAN, we may have a

fast product.

Mike Riddle reports that Microsoft's true compiled BASIC for the IBM PC is at least a year off. We can take advantage of large chunks of the work done to port SPL to the 8086 (if we go that way for MicroCAD) and also port QBASIC. This would let us slip in with an efficient version of the most popular business BASIC on the hottest new machine. It would annoy Digital Research immensely, but we're not doing anything wrong as our implementation has no connection with theirs. The current QBASIC could probably be ported to the PC in less than 1 month assuming the SPL port were completed first.

Again, this would be a general CP/M 86 product, not limited to the PC. We could also sell it on the IBM Displaywriter and any other CP/M 86 machine. As CB80 sells for the Z-80 at $500 and most CP/M 86 stuff is higher, we could probably get $500 a copy retail for this without problems.

John Walker developed a comprehensive commodity trading package in 1980 and 1981 in QBASIC on the M9900. This package allows almost any function which would be required by a trader, and is easily expanded for custom requirements. There is no comparable package on a microcomputer. Jack Stuppin feels that there is still a market for this package, although there are several other well-entrenched competitors. I tend to agree, assuming that the package were moved to either an Apple or the IBM PC, and that superb quality user documentation were prepared (only the first chapter of the manual was written, and that was a real effort). The problems are as follows. First, there is no easy path from QBASIC to either of the ideal target machines (but see above project). Second, anybody who works on this package must first master the concepts of securities trading. Third, it would enormously expand the market for the package if it also handled stock trading (easy, as long as a limited number of stocks were handled, and you understood the differences). I understand the package, but don't have the time to finish it. I'd like to talk about it with anybody who is interested in it.

As the potential products came into sharper focus, so did our plans to deploy our technical resources to get them done. Here's the first proposal for allocating people to projects.

The following is a suggestion for division of work on the development of the initial Autodesk products mentioned in the “Autodesk Products” bulletin (Revision 3).

Few specific assignments have been made to Dan Drake and John Walker because both will probably be kept busy full time answering all the questions regarding the code being moved from the 9900 environment, plus running the company and acquiring hardware and getting it to work. Both will be available as required for question answering, fire fighting, and assistance.

The following items are not directly related to products (though some of them may be integrated into one or more of the products listed above). They are of importance to Autodesk's business.

What is an Apple? What languages exist on it? How can CP/M programs be best installed on an Apple? What percentage of Apples have Softcards? How standard is the Softcard CP/M? How are programs best gotten on Apple discs?

What formats are popular for 5 1/4 inch discs? Which are used by CP/M systems? Specifically, what physical hardware and controllers are used by: IBM PC, Apple/Softcard, HP-125, Xerox 820, Micropolis, Northstar? What is the best configuration for an “Octopus” machine to allow us to write discs for all these machines?

Survey of existing screen manager packages. Choice or development of a general screen input package. Development of a general file driven message package.

How do we prepare documentation? We have an immediate need to produce “Digital Research or better quality” manuals and a near-term need to produce IBM-quality typeset manuals. We need to survey the tools for preparing copy for such manuals and the services that exist to turn this copy into camera ready copy.

Survey existing companies that copy discs to order. What services do they supply (format conversion, etc.), and what formats do they support? Do they put on custom labels, etc., and what must we give them?

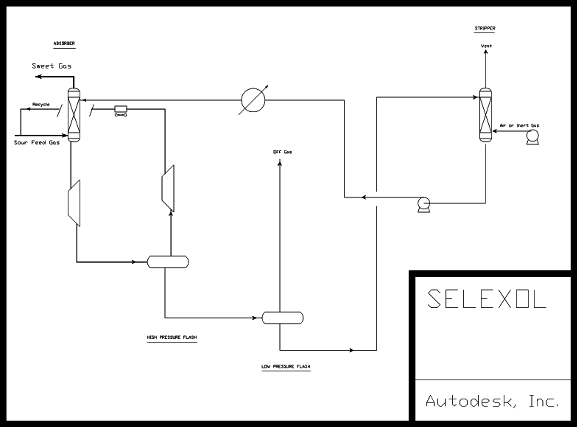

This is one of the first drawings ever made by a customer with AutoCAD. Jamal Munshi of MOMS Computing, our first dealer and customer, drew this schematic of the Selexol chemical process. He kindly allowed us to use it as a sample drawing.

|

|