|

|

With the public offering complete, many people who had been essentially broke the month before found themselves bombarded by those willing to help them solve the problems created by their (largely paper) “wealth”. I thought it would be a good idea to pen an introduction to the investment world for people who had ignored it before in the hope that at least the most egregious fleecers and slimebags would be seen through. Other than details about taxes, which are dated, I wouldn't change a word today.

Fins to the left,

fins to the right,

and you're the only bait in town.— Jimmy Buffett, Fins

When you sold stock in the public offering and your name appeared in the prospectus, you committed an act not unlike pouring blood in the water before taking a swim in shark-infested waters.

Whatever your financial situation may be, to those who read the 40,000 copies of the prospectus we paid to print, you “have money”, and can be expected to be pursued by those who want to “help you manage it”.

Look out.

I do not presume to suggest to anybody what they should do with the money they got from selling the stock. It's yours; you earned it. The only purpose of this note is to share some of my thinking about the question we now face: “what to do with the money”. The thoughts herein are biased by my own financial situation and may be completely inapplicable to yours. I'd also like to share some words of warning about some of the predatory types who will soon begin to circle.

And of course, please assume that everything I tell you is totally wrong and “do not take any action without consulting with your own financial advisors”.

Well, we are going to be paying a lot of taxes this year. I think that this year I'm not going to be doing my own taxes. The proceeds from the sale of the stock will be considered a long term capital gain for federal taxes, assuming you sold stock purchased at inception. But remember that California has a three tier capital gain structure and that you don't get the lowest rate until you hold the stock for five years, so none of us will be in the lowest California bracket. If you exercised any options this year (and of course everybody did), you also have to calculate Alternative Minimum Tax (AMT), even if you don't end up owing any. And remember that California also has its own Alternative Minimum Tax, which will crank the effective California capital gains rate up to about 9.5% (don't complain: we all have to Do Our Part to contribute to the entrepreneurial renaissance in New Hampshire and Texas). So in any case, the calculation is going to be complicated.

Here are some random thoughts regarding the tax situation:

First of all, we can't wait until next April 15 to worry about the taxes. We'll have to make the next estimated tax payment on September 17. So a goodly part of the money you kiss hello on July 8, you will be kissing goodbye in September. You'll absolutely have to be able to make a quick shot at your 1985 tax liability and make that payment, because if you miss it, you can kiss something else goodbye. Estimated taxes are tricky, and there are several gimmicks which can help you keep the money in your hands for longer. For example, if your withholding plus estimated taxes for each quarter exceeds last year's tax liability, you don't have to make additional payments; you can just pony up the balance next April 15 and file the “hey, it's cool” form. But to do this, you'd have had to have made the qualifying payments last April and June. Did you? I sure didn't. Also, at the end of the year, the buggers will probably hit you for a deficiency because you didn't make estimated tax payments in April and June. You'll have to prove that your large slug of income didn't come until third quarter. Be sure you can.

Also, when calculating your taxes for estimated tax purposes, remember that you'll probably benefit substantially from income averaging this year. Don't overpay estimated taxes because you forgot this when making the estimate.

This probably doesn't apply to anybody, but I'll mention it just in case. If you have any long term capital losses (that Atari stock you bought when video games were going to the moon, the $800 gold coins, etc.) that you haven't realised, take the losses this year. You can offset long term capital losses dollar for dollar against gains, but you can only deduct $3000 of loss per year in excess of gain, so this year you can flush out all those unrealised losses. If you still want to hold the assets, buy 'em back more than 30 days later (the delay is to avoid a “wash sale”, discounted for tax purposes).

Also, I don't think that anybody will have a significant excess AMT liability, but maybe your kid went to a painless dentist and you have some Intangible Drilling Expenses and are in AMT land. As long as your AMT exceeds your ordinary income, additional ordinary income is taxed at only 20%. So if you can discretionarily generate ordinary income (such as selling short term stocks at a gain, etc.), do it as long as your ordinary tax doesn't reach the AMT number. Conversely, if you're in a position of excess AMT, you want to put off taking any short term capital losses or deductible expenses (charitable contributions, etc.) because as long as you're in a 20% marginal bracket, Uncle is paying only 20%. If you can delay them to next year, you may be in a higher bracket.

All right, you've paid off all the bills, beaten the wolf back from the door to at least the porch steps, and you have some money left over. Now you're ready to talk to those guys who are calling you five or ten times a day to tell you what to do with it, right? Wrong. First, make sure you do the obvious little things, such as (if you haven't already done so) prepaying your IRA for 1986. You can earn the interest on $2000 ($4000 if married) tax free for a whole year by prepaying now. Next you have to think about “your portfolio”.

Most of the paper peddlers who call you will consider your cash and

tell you how to deploy it to “meet your financial goals”.

The cash will become a mix of investments which will be called

“your portfolio” (as if you carried it around with you all

the time—though in a sense you do by worrying about it).

Unfortunately, they often ignore the other 90% of your net worth.

What's that? Your stock in Autodesk. So remember that your portfolio

is already invested 90% or more in a high-risk, high-tech company, so

anybody who advises you to put any of your cash into similar stocks

for “aggressive growth” is telling you to increase your

concentration in this sector. What you probably want is to balance

things by staying pretty conservative with where you put the cash, so

be sure whoever is advising you understands the whole picture. The

best book I've seen about portfolio balancing and

evaluating different risk factors is called Inflation-Proofing Your

Investments by Harry Browne.![]() I do not agree with much of the advice

and specific recommendations given in this book, but the sections on

valuing differing kinds of holdings (equity in a house versus bank

deposits versus shares you can't sell) are very well written and easy

to follow.

I do not agree with much of the advice

and specific recommendations given in this book, but the sections on

valuing differing kinds of holdings (equity in a house versus bank

deposits versus shares you can't sell) are very well written and easy

to follow.

You will probably be contacted by people who call themselves “financial planners”. There are two kinds of people going by this name. Some prepare a plan from information you supply, for a fee. Most derive their income from commissions on specific products they recommend and then sell you. 'Nuff said.

If you're looking to stash the cash immediately in a safe place that generates income, I'd recommend Capital Preservation Fund, which I have used since 1978 and with which I have had absolutely no difficulties. They invest only in US Treasury Bills, which are generally considered the safest investment in the world. They also have a fund which is free of both California and Federal income taxes. You can write checks on either fund. (Again, I'm not telling you to put your money there, and they may run off to Paraguay with it tomorrow. But if they do, I'll lose a lot.)

Before getting involved in any investment other than ultra-safe short

term things like T-Bills, it's worth spending some time learning just

what the rules are and what all this stuff they're trying to sell you

is. My favourite introduction to the game is a book called How to

Buy Stocks by Louis Engel.![]() I also like The Only Investment Guide

You'll Ever Need by Andrew Tobias,

I also like The Only Investment Guide

You'll Ever Need by Andrew Tobias,![]() but I like this book a lot less

than some people do and consider it mistitled. I'd read it for

background, but not advice.

but I like this book a lot less

than some people do and consider it mistitled. I'd read it for

background, but not advice.

I have a lot of other references and information about investments. You're welcome to borrow any of them. Most are in my office.

“When I hear the word `culture', I reach for my gun.”

— Hermann Goering

“When I hear the word `leverage', I reach for my coat and head for the door.”

— Dan Drake

“In investing money the amount of interest you want should depend on whether you want to eat well or sleep well.”

— J. Kenfield Morley

Dan Drake suggested that I add a section talking about the kinds of things to watch out for. Frankly I'm of two minds about this. Walker's first law of investing says, “If you don't totally understand it, ignore it”. I cannot possibly give you enough information herein to make an intelligent decision, so I'll just concentrate on the lingo. But if you're unwilling to take the time to learn the game, I think you're better off not playing at all. Professional money managers have years of training, access to extensive libraries of research material, massive computer support systems, and full time analysts watching every piece of data. Yet few of them do better than random chance. If you intend to better them, realise you're going into a business venture and prepare to spend the time and effort a business requires.

What follows is Walker's acerbic, opinionated, tour d'horizon of investments.

With your money you can spend it on stuff or paper. Stuff includes BMW's, yachts, Big Macs, houses, and gold. Paper includes stocks, bonds, CD's, options, futures, options on futures, futures on options on futures on gold, etc.

Bonds are debt. You give somebody your money and they agree to pay you back someday (if soon, like 90 days, it's “short term”, if not, like 30 years, it's “long term”. Exercise: what does “intermediate term” mean? See, it's not so hard!), and to pay you interest at some percentage rate. Usually, the longer the term, the higher the interest. But the longer the term, the higher the risk, because if interest rates go up, the value of your bond goes down. Also, there's the risk that the issuer won't pay off, or may even stop paying interest. Issuers with tons of cash and a record of prudent financial management such as the U.S. Government get to pay less interest than fly by night operations like IBM. In general, the greater the risk, the higher the interest.

Stocks are equity. You own part of something. This can range from the telephone company to Autodesk. Generally stodgy old companies pay you a dividend in cash and are much safer. Utility stocks are the stodgiest of all and are very similar to bonds. Stocks in established, well capitalised companies such as Computervision or Union Carbide are much safer than wild-ass startups like Apple, Intel, Tandem, and Autodesk. This is because it is less painful to lose your money in good company.

All the rest are pinstripe Las Vegas in New York (or Chicago). The purpose is to have the most fun as you lose your money.

So what's leverage? Leverage is how you can lose or possibly make money even faster. Options (buying, not writing), buying stocks on margin, and futures are ways to obtain leverage. You can, by proper application of leverage, lose even more than you invested. Isn't that neat? (All right, this is somewhat unfair. Leverage, properly applied, can let you hedge illiquid assets and shift risks to speculators willing to assume them. Leveraged markets are essential to the efficient deployment of capital in a free market. See you at the track.)

And I could go on and on. This is really fascinating, and as one who has long been a market follower and player, I could go on for hours. But as I swore off all market playing when I started Autodesk, I'd rather not. It seems to me that it's a lot easier to make money than to multiply it, and for the moment, that's my focus.

Since all selling shareholders signed a six month lock up agreement, sales of stock under Rule 144 are not an immediate concern. This is good, because all the people who will call you about their “restricted securities program” can be got rid of for at least six months. But 1986 will bring them out of the woodwork. Subject only to the constraints of the law, you will then be able to sell your stock through any broker willing to do the paperwork and abide by the rules.

You should be concerned, however, with sales of stock affecting the price. Remember that there are only 1.4 million shares out there. We hope that a large percentage of those will be in “strong hands”, that is, long term holders. Thus the “float” or volume that actively trades may be quite small. As a result, throwing a block of 10,000 or 20,000 shares on the market may knock the price down significantly. As a result there may be an advantage in selling the stock through a broker who is a primary market maker in the stock, since they will sometimes have a better feel for how well the market can accept the stock and when is a good time to sell it. Initially, the market makers will be our underwriters. We hope to pick up additional market makers in the future (the more the better as far as the company is concerned), and we'll let you know.

Remember that brokers get a commission when they sell stock, and that people will be actively prospecting for this business. You will receive calls that begin “I have a buyer for 20,000 shares of Autodesk stock. If you're interested in selling, we can do the transaction, and since I have the buyer already, the price won't blip down”. And when you agree to sell, he'll start looking for that buyer.

Anyway, watch out. From now on, assume you are a target. Not everybody who calls you up blind with a financial “opportunity” is a total sleazebag trying to loot the efforts of your hard work. I've made a list of those who aren't, and have already written the title at the top of the page. Now all I need is the first name. Let me know if you encounter one.

And remember, these guys can consume hours and hours of your time.

Don't hesitate to be rude. I've found only one thing so far that gets

rid of these guys immediately without overt hostility, and that's

saying the magic words, “That's very interesting, but I'm totally

broke”. And now even that won't work.![]() Anyway, your time is your own, not theirs.

Anyway, your time is your own, not theirs.

There's a reason they're called brokers.

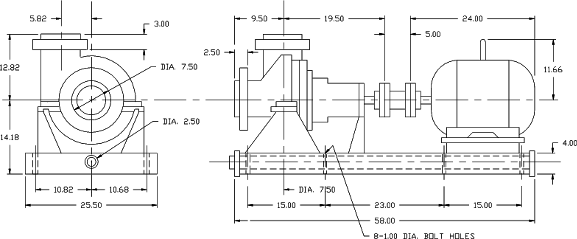

Peter Barnett drew this pump in 1984 to illustrate mechanical applications of AutoCAD. It has appeared on the AutoCAD sample drawings disc from Version 2.0 to date.

|

|