|

|

After the original working paper was mailed, I had numerous telephone conversations with the people who received it. I wrote the first Information Letter and mailed it before the meeting in an attempt to address several points which came up repeatedly in these conversations. This letter inaugurated the series of Information Letters which have continued up to the present day.

This letter is intended to clarify some points in the Marin Software Partners Working Paper which you should have already received, and also to bring you up to date on some discussions about matters not covered in the original paper. The organization meeting will be at 11:00 A.M. January 30, 1982 at Marinchip.

Most of the questions recipients of the Working Paper have had related to the partnership structure of Marin Software Partners. I'll try to clarify what we want, point out potential problems, and look at alternatives.

Let's start with basics. We are planning to organize a business in which all the founders will have an “equity stake”—in plain language they, collectively, will be the owners of the business. There are three basic ways such a business can be structured. The first, and most simple, is the general partnership. This is what is usually meant when the word “partnership” is used. In a general partnership, all partners participate in the operation of the business and share in its profits or losses proportional to their ownership share. Each general partner is subject to unlimited liability in regard to the operation of the business, and is liable for debts incurred in the partnership's name by any of the general partners. This means that a general partner who lacks a controlling share of the business must trust the other partners sufficiently to expose himself to unlimited losses if they misjudge or act improperly. Steps can be taken to hedge this risk, such as an insurance policy against liability suits, embezzlement, etc., and statements in the partnership agreement which allow borrowing only if approved by unanimous consent of partners.

A limited partnership is composed of one or more general partners, who have the same responsibilities and liabilities as before, and one or more limited partners whose liability is limited to their initial investment. Thus, while a limited partner may lose everything he contributed to the partnership, he may not lose more. In this sense, a limited partner is like a stockholder in a corporation. Limited partners do not have any direct say in the operation of the company—this is the function of the general partner(s). The most common application of the limited partnership is a venture where people want to put up money for a venture in the hope of sharing in its profits. The general partner takes the money, does something with it, and distributes the appropriate share of the proceeds back to the limited partners. This is a common way of financing oil and gas exploration, and is used extensively in the venture capital business. In any case, the limited partner retains an unlimited upside potential gain while limiting his loss to his original investment.

The third way of organizing a business is incorporating it. A corporation is by far the most flexible form of organization, but it has several important drawbacks for a venture of this kind. Most critical is the question of royalty income. The IRS holds that a corporation with 15 or fewer stockholders which receives a majority of its income from “passive sources” such as royalties and interest is a “personal holding company” and is subject to a 70% tax rate. This ruling was introduced to prevent people from forming companies to hold their investments and by so doing paying far less tax on the income than if they were taxed at the higher marginal rate which would result if the income were added to their regular employment income. The problem is that a software company may very well receive all its income from royalties if it licenses vendors and distributors to manufacture and sell its products, and this leaves such firms potentially liable under this provision. We have asked an attorney knowledgeable in this area about this problem, and he says that to date no software firm has been penalized under this ruling, but that there is no question that they are potentially liable. Nobody has even asked for an IRS ruling out of fear of alerting them to this source of income. The upshot of this is that if you intend to sell software for royalties, you'd better not incorporate until you're big enough to escape the provision through the size test.

The second drawback of a corporation is that income from the corporation is taxed twice: first as “corporate income”, then again when it is received by shareholders as dividend income. Federal law allows you to declare a corporation “Subchapter S”, which means that income is distributed directly to holders and no corporate tax is charged. This neatly solves the problem (unless you're too big for this treatment), except that good ol' California doesn't recognise Subchapter S. This means that you still pay double tax to California on your income. With California marginal tax rates at 11%, this is substantial dollars. Thus, most California Sub S corporations list the principals of the company as employees and try to pay out all their profits as salaries to the principals. Since salaries are deductible from corporate income, this avoids the problem. But there are some catches. First, the tax people have every incentive to bust you if it looks too much like you're using the salaries as a sham for dividends (which is exactly what you're doing, of course) since they make less that way. Second, you have to pay Social Security tax, unemployment tax, carpet tax, etc., on salary payments. Thus, there's really no clean solution to this problem. You say, “well, why not just leave the money in the company and let it collect interest at the low corporate tax rate until I need it”. Gotcha again! You can't leave more than $150,000 in the company unless you can show it's legitimately needed without triggering punitive measures.

Third, a corporation is a pain in the ass to run. The workload involved in filling out forms, filing statements with the state and IRS, etc., is easily 5 times that of a partnership of similar size. It takes about a tenth of a full time person to do, and unless there's an obvious return, it's therefore to be avoided.

The benefits of the corporation are also often overstated. The much vaunted limited liability of the corporation can evaporate if the corporation can be shown to be a sham set up only to limit the liability. In any case, directors of corporations are subject to lawsuit against their personal assets based on the acts of the corporation. Thus, it doesn't look to me like there's any reason to consider incorporating this business at this time.

Since we already have a corporation, Marinchip Systems Ltd., we can make that corporation a general partner in Marin Software Partners. It may be possible to structure things so that the liability of the partners is limited, and the principals of MSL are protected to the extent that the corporation provides. We will have to seek legal advice as to whether this will work and how it must be done, and we will do this as we form the new venture. It just looks like this is the best option if it will work.

I don't want to get everybody all worked up about this issue of liability. In deciding how to organize a new business, you have to balance various considerations. You want a structure in which the responsibility is assigned in proportion to the commitment of the various participants. You want to limit the potential loss a participant can sustain as much as possible. You want to minimize the percentage of your gains that the tax man will pocket. You want an organization which can grow and change without catastrophic problems.

From almost every consideration except that of taxes, a corporation is the best. But since we have the potentially disastrous royalty tax problem, we can't incorporate safely. Thus, a discussion of liability is in order as that is the major difference in the two forms of partnership. This business is very different from most start-up ventures. We are capitalizing the company by contributing money to the original “pot”, and are creating our products almost entirely out of mental effort. We have no employees, and our fixed costs are almost negligible. We will have no debts to anybody (I am a fanatic about this), and our capital investment will be a relatively small percentage of net worth. The software business is just about optimal from the standpoint of product liability. Programs blow up in people's faces only figuratively, and unlike most other things, software is usually sold with no warranty, or one limited to refund of the purchase price within, say, 30 days.

As a result, the liability exposure of a partner in this venture is about as small as could be possible in any business. Basically, if we reach the point where the bank account is drawn down to zero and we haven't sold anything, we fold up our tent and go back to the salt mines. It's hard to imagine how you could lose more than your investment in this kind of venture. Thus, being a general partner is not the risky thing it is in a real estate venture where you're signing up to be liable for a chunk of a $30 million floating rate construction loan on a building for which there may be no demand when it's finished 24 months from now. I don't think the liability issue here is something to lose sleep over, and I personally don't care if I'm a limited or general partner. I do realize that from your questions some of you are concerned about it, so I've tried to beat the issue to death looking at it from all sides here. That's not to say that any issue in forming a company is unimportant, but I think that you have to look at it in the light of the nature of the business, and in this case liability is not an overwhelming problem.

Most of your questions have been related to how the company may change after it has been in operation for some time. I'd like to discuss some of these issues here. The problems you've raised are problems that I know no complete, clean solutions to. However, business, like life, is an endless series of problems to overcome. You always try to avoid problems where possible and mitigate the effects of the ones you run into. But if you refuse to do something because there are potential problems, you end up never doing anything. But enough preaching…on to the grimy details.

“How do we handle it if one partner doesn't meet his commitments?” This has been the most commonly asked question, indicating that I am no more cynical about participants in business ventures than you. Obviously, we only want to go into business with people we respect and trust, and the first level of screening is performed when we get together and decide who wants to work together in this venture. If somebody seems not to fit, either based on their goals, their approach to the venture, or their ability to get along with and work with the others, it would be a mistake for all concerned for that person to become involved in Marin Software Partners. Of course, you can make a mistake. I made such a mistake in my selection of an original partner in Marinchip, so I'm very aware of this possibility. The solution in that case was what usually proves best; the rest of the partners buy out the partner who has lost interest in the venture. If the business is prospering, this buy-out can be paid for out of sales revenues. If the business is failing, the partner's share is not likely to be worth much in the first place. I know of no solution to the case of the partner who just refuses to work or becomes obstructive but who refuses to be bought out. So we don't include any assholes, O.K.? (It might be possible to write the agreement in such a way that the other partners retain an option to buy out a partner for a certain price for a stated term. I think this is a terrible idea, since it would put the financially strong partners in a position where, if the business “took off”, they could grab the business from the less strong. While, of course, nobody involved in this venture would think of such a thing, it wouldn't contribute to a partner's equanimity knowing such a coup were possible.)

“Are decisions affecting the partnership made by unanimous consent or by majority of partnership share?” This question is really irrelevant if the limited partnership is used, as MSL would make all decisions. I also don't know the relevant law (we will, of course, find out as we work with a lawyer to draft the partnership agreement, although I'd like to believe you can have anything you want put in the agreement). I think that the majority share makes the most sense, even though it has its obvious risks. After all, all stock corporations work that way and they seem to make out all right. I'd be worried about one stubborn person being able to immobilize the entire company (after all, I've been known to be stubborn—and dead wrong—myself).

“Suppose the company takes off and I want to quit my job and do this full time. How can I increase my share?” In this case, you would purchase an additional share in the partnership at a price agreed to by the other partners. Your share might be sold to you by another partner who wished to reduce his share (MSL might want to “cash out” to free up money for other ventures, for example), or could be a new share which effectively dilutes the shares of all the other partners. The partners whose shares were being diluted by this act would be compensated by the payment you made for your additional share, and by the presumed increase in revenues which would result from the additional work you did for the company. The price you pay for your additional share is the price the other partners agree to sell it to you for. If the company is a corporation, change “partnership share” to “shares of stock” and everything is the same.

“How do we bring in new people?” In the case of new partners, the case is exactly the same as that discussed above for an existing partner increasing his share. Of course, a new partner may buy in by supplying any form of consideration, such as rights to a software package he had developed. If we decide to expand the general operation side of the business, we may decide to add some conventional employees. This would just involve salaries paid out of the general revenues of the business and doesn't affect the partnership in any way.

“Suppose I want out?” This is just the reverse of the case of adding to your share. You sell your share back the other partners for whatever they're willing to pay you for it. They recover what they paid you by the increased shares they own after yours are liquidated. Of course, if they don't want to sell, you're stuck. They'd be stupid not to, though, for otherwise they would have to continue to pay you your partnership share of the revenues in return for your doing no work.

“I'm worried about having the business expand to the point where I have to quit my job. What do I do if this happens?” This is the kind of problem that is good to have. Basically, you have to calculate the equity value of your job, which is just like valuing a company: what is the income, how secure is it, what are the growth prospects, and what is the equity I sacrifice by quitting (seniority, pension fund equity, future employment prospects, etc.). If the job is so valuable to you you'd never quit, then you shouldn't consider going into business for yourself. If the job has a value (they all really do, of course), then you should only quit to take a job with greater value. I'd quit a $50K job with, say, Consolidated Engine Sludge to take a $10K job with Advanced Robotic Widgets if I had a stock option for 20% of the company, but everybody has a different situation and has to make his own decision. Working out the value of your job in your head is a worthwhile effort in any case as it gives you a better perspective on what you've got. I believe everybody constantly acts to maximize their overall gain in life (not just economic, of course; personal happiness, adventure, are calculated in as well), and that if the time comes where participation in Marin Software Partners is seen as better than your current job, you'll have no trouble making the plunge. Those that can't are the Hamlet types who never do anything and always fail in business anyway.

“I'm not sure I have the experience to be in a company like this.” I have found that a sincere desire to be in business for oneself and to work hard is far more important to success in business than detailed technical knowledge. If you can do a job well and the partnership needs that job done, you belong in Marin Software Partners. We'll have to look at the mix of talents we have in the people who are interested in forming Marin Software Partners and address the areas where we're deficient. We'll almost probably have to go outside for advertising preparation, but we'll probably have the in-house capacity for all the technical writing we need. At this point we can't say whether anybody fits into the company—we can evaluate that only after we see who's interested and who's not. Being in business is an excellent way to learn about thousand of things you never intended to learn about. If you're looking to learn new things and expand your horizons, this is one way to do it (although getting run over by a truck may be less painful).

Some people have expressed concern about the continuing support burden of products we decide to terminate because of bad sales. This is a non-issue. When a product is terminated, support of it is terminated and those who inquire are simply told “that product is discontinued”. Only in the computer business does the insane idea that by buying a $300 product (or, for heaven's sake, a $35 product) entitle the purchaser to all products of the implementor's mind unto eternity and unlimited free consultation at the press of a touchtone button. If you buy a refrigerator, you don't expect to get a new one every 6 months because a new model comes out, and the same thing holds here. We warrant the product will agree with the manual and will work for, say, 6 months after purchase. When that expires, our connection with that product is totally severed. We may choose to offer existing customers a good deal on new versions, but that is a marketing tactic, not a moral imperative! If we find the mass market we seek, we can't afford to talk to one in a hundred end users. We have to make the software work in such a way, supported by the manuals, that users can use the package on their own, and provide the aids to those who distribute the software so that they can answer user questions locally. This isn't impossible: numerous products meeting this criterion sell well currently. So, when we terminate a product, it's done.

I'm using Marin Software Partners as a working name for the company. I haven't thought at all about what it will really be called and don't think this is of any importance at this time.

Several people have asked about how much of a share of the company they would be expected to buy and how much it would cost. It's hard to put numbers on this until we see who's interested and at what level of effort, but I can give you some rough background on how this will eventually be crunched out.

The first question any partner must ask, as detailed in the Working Paper, is “How much time can I commit to the venture”. Once you know that (and I'm assuming everybody will be able to say at the organization meeting), we can begin to guess at a share. Ideally, everybody should buy in at a share proportional to their time commitment. Let's say that of the technical partners, a total of 100 hours per week is available. Let's assume than MSL is buying 60% of the company by its cash contribution and the technical partners are buying a total of 40%, and that MSL is contributing $50,000 to found the company.

Now if you have 15 hours per week to work for Marin Software Partners, your ideal share would be 15/100 or 15% of the 40% owned by the technical partners over all. Thus, your share of the total company would be 6%. To purchase this share for cash, your contribution would be (50000/0.60)*0.06, or $5,000. If all the technical partners purchased their shares of the company for cash, the company would start with an initial capitalization of $83,333. If the company made $80,000 profits in the second year (this is the level MSL was running at its peak), then the partner's share would be paid off at this point. If the company reaches $1,000,000 in profits then the partner's original $5,000 investment will be yielding $60,000 per year in income.

If you don't have the $5,000, but want to buy in at that level, we'll find the money for you to borrow. If that number just looks too doggone big, you might choose to buy a lesser share and reduce your time share accordingly. This is a gamble, of course, since if the business begins to grow rapidly and you wish to increase your share, it will cost you far more to do so (as a percent of a company earning $100,000 per year is worth a lot more than one of a company earning zero). Conversely, if the business starts off poorly, you might be able to pick up a piece for less.

Again, it's too early to put down hard and fast numbers, but you've asked, and need to know just what the magnitude of this venture is going to be. My gut feeling is that the absolute bare bones Spartan scrape by high risk minimum to get started in this business is $50,000 initial capital with as little of that spent on hardware and fixtures as possible. I'd feel comfortable with $100,000, and feel that if we couldn't make it with that, then we probably couldn't make it with a million. MSL has about $50,000 in liquid assets to funnel into this venture, so I think we can plan to scrape up the kind of money to give us a reasonable shot at success. MSL's fiscal year closes on January 31, so on the 30'th we'll pass out our preliminary financial statement and let you see where MSL stands in this venture.

Once we see just what we've got, we may have to line up some additional financing. One possibility is for somebody, like me, who's got some cash and believes in this venture to grant Marin Software Partners a line of credit which it could draw on, at, say 5% above the prime. This would provide Marin Software Partners with a source of additional funds if it needed them, which it would really have to to pay my usurious (but utterly risk-justified) rates.

We've been asked about what role the principals in MSL (John Walker and Dan Drake) will play in the partnership. They will participate in the operation of the company and share its results by virtue of their ownership and operation of MSL. In addition, they may choose, as individuals, to become limited partners in the venture. They would do so based on their desire to work, exactly like other limited partners, on technical projects to be marketed by Marin Software Partners. If they do so (and I certainly haven't made up my mind—I want to, but where is the time to come from?), they will buy their shares just like anybody else and participate on the same basis.

This is an issue that isn't settled yet, and I don't think it's very important until we see just who's interested.

Everything you've read so far relating to this company has stressed the risks of any business venture, the depth of the commitment involved, and the potential problems and catastrophes which can befall one who dares venture from the corporate womb. I keep hammering on these points because I've found that underestimating them is the most common problem people have when going into business. I don't want you to conclude, however, that I lack enthusiasm for this venture or that I expect it to fail.

I think that we're at an absolutely unprecedented juncture of

history. I can't think of any time in the entire human experience

when so much opportunity existed for technical people, opportunity

which they could participate in with very limited risk. Most

great business opportunities have required far greater infusions

of start up capital which was consumed just paying for physical

plant before anything was made to sell. Our products are created

by almost pure mental effort, and are manufactured on trivially

cheap equipment at a tiny fraction of their wholesale cost. It's

almost like counterfeiting, but legal.![]()

At the same time, we're entering a marketplace which is expanding at an unbelievable rate. Wander through any office tower in downtown San Francisco and look at how many desks have computers on them. Say, less than 1%. In 5 years or so, 80 to 100% of those desks are going to have computers on them, and those computers will be running programs that have not been written yet. In less than 6 weeks, over 100,000 IBM personal computers have been sold. There is little or no serious application software for that machine at present. If we make $100 per copy on a database system for that machine, and sell 50% of those customers on it, we've pocketed five million bucks. And how many will they sell in the next five years….

The potential rewards of this business, which is the field that you and I are technically proficient in, almost compel one to participate on an equity basis. There's almost no salary that's enough to reward one for giving up his seat at this cosmic money gusher. There's no doubt that we have the technical proficiency to produce products as good as those any of our competitors are selling. The quality of our technical writing is continually mentioned as being superb. We know we are incompetent at advertising, but we know where to purchase that talent at a reasonable price (at least, compared to page rates). We should have at least one salesman-partner—this is a serious lack and if you have any contacts in mind please forward them. If we have to do without, though, we're not doomed, as we're already plugged into the marketing channels through Lifeboat, who already has a sales organization targeted at our market. There are enough precedents for the “strong technical, weak sales” company making it on the strength of their products to convince me that this business isn't like selling toothpaste.

The last thing I want to do is to sell anybody on getting involved in this venture who is less enthusiastic about it than I am. But I can't help saying to anybody who doesn't want to get involved, “Do you ever expect to see an opportunity this good come around again in the rest of your life?”. I'm not talking about this company specifically, as you might have legitimate worries about getting involved with the people and slant of this particular venture; I'm saying that here we have an exploding market that you understand technically, which can be entered with little capital, where huge corporations are trying to promote your work to sell their hardware, where growth capital is readily available when it's needed, and where there's still time to get in without being an employee or minor stockholder in a big venture. 99.99% of all the people in this country live their lives without ever having the kind of opportunity we have in front of us today. Those who do not choose to take it should not count on it knocking again.

Some people have interpreted the product development structure suggested in the Working Paper as smacking too much of the kind of bureaucracy they dislike in their current jobs. I think that one of the great advantages a small company has is its ability to react rapidly and get things done before the competition does, and that any hardening of the arteries which prevents this spells disaster. On the other hand, if the organization is so loose that you don't know where the money is coming from, how can you decide what you should be doing? My goal is to provide the minimum level of structure needed to define, develop, market, and promote products, targeted at all times to maximizing our profits. I think the structure I suggested meets this criterion. I can think of nothing less that will serve. On reflection, I think that it may be wise to designate one partner as “product manager” for each product, even if several partners are collaborating on it. This isn't to introduce unnecessary hierarchy, but simply to provide one person who will coordinate user communications, contact with headquarters, integration of work by other partners, etc.

To those of you who know the esteem in which I hold Don

Lancaster's book, The Incredible Secret Money

Machine,![]() some of

the concepts you've seen here may seem alien or repugnant. My

theme all along in this is “the game has changed”. To be blunt,

they're playing the ball game with real balls now. It's possible

to follow the Don Lancaster route and earn a reasonable income for

life while maintaining your own freedom and lifestyle, but you

only generate income when you work, and you must resign yourself

to seeing people with less merit in your eyes advance beyond you

on the ladder of material success.

some of

the concepts you've seen here may seem alien or repugnant. My

theme all along in this is “the game has changed”. To be blunt,

they're playing the ball game with real balls now. It's possible

to follow the Don Lancaster route and earn a reasonable income for

life while maintaining your own freedom and lifestyle, but you

only generate income when you work, and you must resign yourself

to seeing people with less merit in your eyes advance beyond you

on the ladder of material success.

Everybody has to decide what's important to them. For some people, it's knowing that their work is the best. For others, it's understanding things. Some people measure their value by certificates on their walls, still others by certificates in their safe deposit boxes.

If you're a computer person, you have a rare skill that's much in demand. If you can produce a given kind of work, I think you should demand as much for it as you can get, consistent with the constraints you're willing to accept on your lifestyle. My own personal belief is that in a venture of this kind I have a reasonable prospect of realizing far more for my efforts than from anything else I could do with my time. I think that by taking a less serious approach to this business you only reduce your prospects of success. Thus, today, I think this is the best option, which is why I'm willing to bet so much on its success. If we fail, we'll lose sums of money which are significant, but which are in the nature of a setback, not a disaster. If we succeed, we'll be able to put the whole job game behind us. And then, hopefully, relax and enjoy the fine things life has to offer.

Existing products: The following products exist already under various ownership and are being marketed by MSL or to MSL customers. We assume that title to the products would transfer to MSP in return for payment by MSP to their owners or partnership share.

INTERACT![]() could be supported by MSP on the IBM personal computer, or

possibly on the Tandy or Apple 68000 machines to be announced

shortly.

could be supported by MSP on the IBM personal computer, or

possibly on the Tandy or Apple 68000 machines to be announced

shortly.![]() INTERACT is written in SPL and an SPL-port

would be implied in any conversion to a new machine. Since the trend

in machines is to better graphics and faster processors, each movement

along this trend makes INTERACT a more attractive product.

INTERACT is written in SPL and an SPL-port

would be implied in any conversion to a new machine. Since the trend

in machines is to better graphics and faster processors, each movement

along this trend makes INTERACT a more attractive product.

The major drawback is that INTERACT needs either a hard disc or at the minimum DS/DD 8 inch floppies to run. This lets out most of the current desktop mass market machines unless somehow INTERACT's dynamic drawing file can be compressed. The major advantage is that INTERACT is a superb product in a virgin market.

By making QBASIC![]() CB80 compatible and porting it to the 8086 and 68000, we can establish

a beachhead in the 16 bit system software market. We are basically

counting on outrunning Gordon Eubanks

CB80 compatible and porting it to the 8086 and 68000, we can establish

a beachhead in the 16 bit system software market. We are basically

counting on outrunning Gordon Eubanks![]() and sneaking in below Digital

Research's advertising blitz. Probably the best strategy is to

continue to pursue OEM buy-outs through Lifeboat, as they have a large

incentive in reducing their royalty payments to D.R. And of course,

QBASIC is now extremely easy to port and each new processor is a new

product. Also, we can use QBASIC for our own applications work.

and sneaking in below Digital

Research's advertising blitz. Probably the best strategy is to

continue to pursue OEM buy-outs through Lifeboat, as they have a large

incentive in reducing their royalty payments to D.R. And of course,

QBASIC is now extremely easy to port and each new processor is a new

product. Also, we can use QBASIC for our own applications work.

Dan Gochnauer's full C for the Z8000 is written in itself and can be ported to other machines. I don't know if this is of any real value except as a low-cost entry in an already congested market. Maybe we should slap the sucker on the IBM and promote it like we just invented C. This won't make us rich, but it may make us some money.

Hal Royaltey's SORT package should be reviewed in the light of competitive products under CP/M. If it shows potential, we can enter the SORT derby under CP/M with it. Maybe we can think of some sexy gewgaw to make it stand out from the pack. Ideas?

Probably no market. Damn shame.![]()

Probably no market except at $25 a pop.

We might be able to clean this![]() up and put it in CBASIC (it has no assembly language in

it) and sell it through Sky & Telescope to CP/M'ers. Probably some

“feechers” should be added first, though.

up and put it in CBASIC (it has no assembly language in

it) and sell it through Sky & Telescope to CP/M'ers. Probably some

“feechers” should be added first, though.

The current QBASIC version can be enhanced to do CP/M

directories, put under CB80 and peddled to CP/M'ers.![]()

We might be able to negotiate a distributorship for SELECTOR V on the IBM in return for putting it up in QBASIC. This might prove to be very lucrative even if our cut was very small.

The following are product ideas of various degrees of definition which might fit into our new line of business.

This is being investigated by John Nagle. It's a screen oriented PERT package with costing and resource allocation, and every manager in a large company with a desktop computer is a potential prospect. We want to target products to this market segment as it is being aggressively targeted by IBM and Xerox and is likely to be one of the fastest growing market segments in the next few years.

This is being kicked around by John Walker. This is an

ultra-simple database which lets you replace things you currently

keep on scraps of paper or boxes of file cards. It requires

absolutely no knowledge other than how to turn on the computer and

type and works in a language as close to plain English as

possible. I think that even if I had SELECTOR, I would still want

a product like this.![]()

MAPPER is the first product Univac has developed which is being heavily promoted as a product in my memory. It is responsible for the sale of numerous very expensive systems simply to run it. We should study it carefully and see if it contains concepts which can be applied to a standalone desktop system. If so, is such a product applicable to any office, or is it salable only to the Univac user base? Might it fit as a product under UNIX?

This is a utility which allows people to design forms, and optionally fill them in. The simplest use is just to allow people to edit forms which are printed on a printer and used as Xerox masters. The stored form can also be used as input to a prompting routine which allows users to fill in the forms on the screen and generate either data files for input to other programs, or simple printed forms with the blanks filled in. This seems like a natural for the transitional “office of the future” which hasn't sworn off paper.

A terminal emulator which can be programmed to present menus and conduct dialogues with the remote system for the user.

Convert it and sell on small systems.![]()

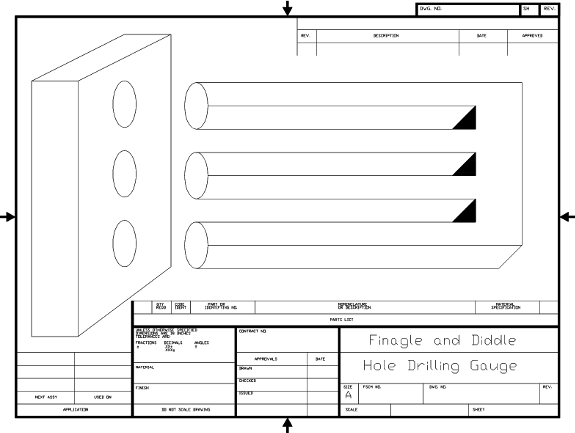

This drawing was done on AutoCAD-80 shortly before COMDEX 1982, and was shown at COMDEX as an example of a “mechanical drawing”. I hand-measured an ANSI A size title block and drew the title block piece by piece. The ellipses were done by inserting circles with differential scale.

|

|